6/5/23. Saturday Finspiration Report.

Yesterday in Australia, XJO rebounded from a negative start to finish higher. XJO up +0.37%.

The past two days have seen bottom-pickers active in the market. On Thursday, the dragonfly doji finished finished back above the 200-Day MA. Then on Friday it consolidated that with a positive move.

Given the events overnight in the U.S., it looks like the bottom-pickers are on a winner.

Overnight in the U.S.

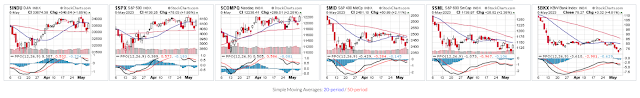

Dow Jones +1.65%, SP500 +1.85%. Nasdaq +2.25%. Mid Caps +2.11%. Small Caps +2.38%. Banks +4.61%.

Apple reported after the market closed on Thursday. It popped up on Friday, +4.7%. The market was also helped by easing of fears in regional banks, KRE up +6.29%.

SP500.

That's a very bullish move last night for the SP500. The chart moved above the 8-Day EMA and the Supertrend switched from bearish to bullish.

Indicators are still shy of giving "buy" signals - but they do seem to be imminent.

This seems set for a test of the recent high.

Commodities.

Commodities (except for Gold) also responded well last night.

Commodities Index +2.25%. Energy +3.39%. Base Metals +1.48%. Agriculture +1.59%. Gold -1.56%.

Ozzie big miners had a bonanza last night in the U.S. BHP +4.49%. Rio +3.56%.

No comments:

Post a Comment