Sunday, 21 May, Weekly Report. Australian Market.

The week started poorly but the past couple of days saw an improvement as a "miracle" in the American debt ceiling talks seemed probable.

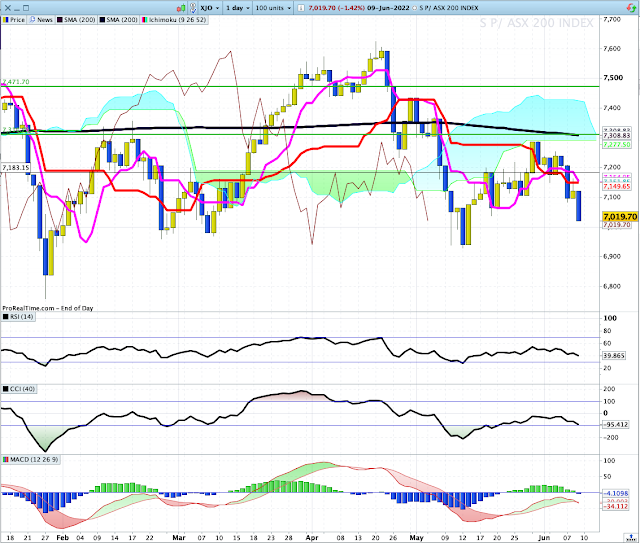

XJO Daily.

XJO finished up a moderate +0.31% for the week but remains in a sideways consolidation movement.

Weekly Performance of Sectors (plus Gold Miners, XJO and Bonds)

Five sectors up, five sectors down and one flat. Information Technology +5.19% continued its good work from the previous week when it was up +1.97%. XEJ, which can be quite volatile, was up +1.6% after being flat the previous week.

The main defensive sectors suffered again this week. XHJ down -0.69%, XSJ -1.08%, Utilities -0.22%. Investors seem to be positioned for a risk-on market with a move out of defensives.

Morningstar classifies the sectors into three groups,

- Cyclicals - XMJ, XDJ, XXJ, XPJ. These have strong correlations to the business cycle.

- Sensitive - XTJ, XEJ, XNJ, XIJ. These have moderate correlations to the business cycle.

- Defensives - XHJ, XUJ, XSJ. These tend to have low correlations to the business cycle.

Momentum

The following data is a medium term measure of momentum obtained by subtracting Weekly RSI from Daily RSI.The only sectors with positive upside momentum are Property (XPJ), Energy (XEJ), Telecomms (XTJ) and Information Technology (XIJ).

XIJ has continued its dominance this week. The sector is getting a little long in the tooth - if you hold strong stocks in that sector - good for you. It's probably too late now for non-holders to go chasing those stocks (e.g. XRO, WTC).

Besides XIJ, the big improvers this week were Energy (XEJ) and Financials (XXJ). Strong stocks in those sectors might be worth a look in the next week.

SP500 Daily Chart.

Stocks/Bonda Ratio.

The Stocks/Bonds Ratio Chart has climbed above the zero line so Stocks are currently out-performing Bonds - risk-on. But, it is usually best to wait until the 5-Day MA breaks above the 21-Day MA before feeling comfortable about a medium term rally in stocks.

Conclusion.

XJO remains in a sideways consolidation. Investors appear to be positioning for a risk-on market, with cycling out of Defensives Sectors and into Sensitive Sectors, and, to a lesser extent, into Cyclical Sectors.

SP500 may be setting up for a move to the downside after a strong week after improving Debt Ceiling talks. If SP500 does drop, we will probably follow and could break to the downside of the current consolidation.

Stay safe.