Friday - felt like Armageddon. XJO down, Dow down, Nasdaq down, Europe down, Commodities down.

Armageddon - that is - if you're a normal person - but those dark villains on the "short" side (and I'm not talking about Friends of Snow White or Santa's Little Helpers) were chugging Dom Perignon out of crystal slippers previously worn by Princess Beatrice, who is by now sleeping rough in Piccadilly Circus.

XJO down -1.34%.

That takes the XJO down to just below the 200-Day MA - where it's been a couple of times recently - and then recovered.Well - anything is possible in this crazy stock market world, but this looks very different from those two previous efforts of flirting with the 200-Day MA.

In the U.S. last night:

Dow Jones -0.65%. SP500 -0.77%. Nasdaq -1.01%. Mid Caps -1.16%. Small Caps -1.65%. Banks -1.08%.

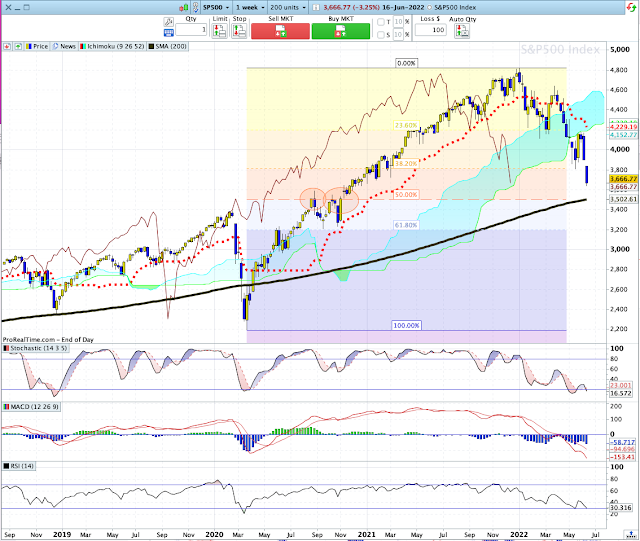

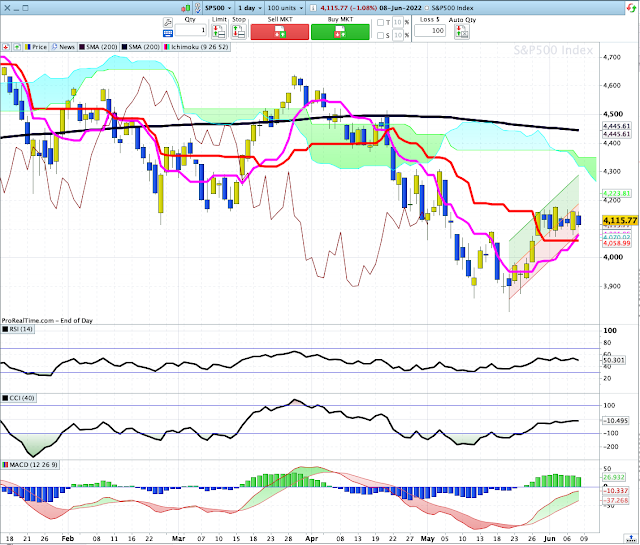

SP500.

SP500 is nowhere near as dire as the XJO. It is way above the 200-Day MA.

As I've noted in the past, XJO decoupled from the American market a long time ago - that's due to the out-sized influence of Technology on the U.S. market - whereas, the Australian Tech sector has a small impact on our market. The Oz market is more influenced by the resources sector which depend on China and Japan for markets.

Still, SP500 is showing weekness. The three indicators in the lower panels are all on sell signals.

Two out of three super-trend lines have turned bearish. But, the SP500 is back to the mid-line of the Andrew's Pitchfork, which suggests it might find support at that level. We shall see.

Commodities.

Commodities Index -1.08%. Energy -0.26%. Base Metals -1.96%. Agriculture -1.91%. Gold +0.28%.Those Energy and Base Metals prices provide little joy for our resources sectors.

In Sydney, SFE Futures for ASX200 is down -0.23%, which suggests a weak opening on Monday.