28/4/23. Friday Morning Finspiration Report.

Overnight in the U.S. Stocks up strongly. Worries about banks went out the door with Tech surging strongly. AMAZON falls 2% after its report coming after the closing bell.

Dow Jones +1.57%. SP500 +1.96%. Nasdaq +2.43%. Mid Caps +1.53%. Small Caps +1.52%. Banks +1.54%.

SP500

That's a big bullish candle on the SP500 and the index finished above the 8-DEMA and Supertrend turned bullish. Those are usually reliable early buy signals. But anything can happen in reporting season.

Amazon is down in extended trading after hours. SNAP is now down -17% and Pinterest down -13%. Tread warily.

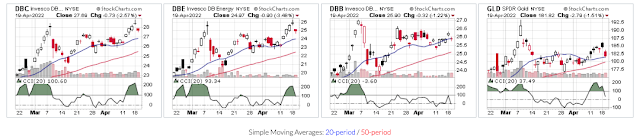

Commodities.

Commodities Index +0.13%. Energy +0.09%. Base Metals +0.37%. Agriculture -0.19%. Gold +0.01%.

BHP up +1.2% overnight in New York. Rio up +1.21%.

Overnight Oz Futures are up +0.75%, so we should have a good start to today's trading in Australia.