Weekly Wrap - Week ending 20 May, 2022.

XJO Monthly Chart.

After three weeks of May, the monthly chart is range bound 6970-7630.

The chart is currently below the 8-month EMA but it is essentially sideways.

We need about another week of data to see how the Monthly chart is travelling

Weekly Chart.

XJO was positive this week, +1%, breaking four weeks in a row to the downside.

The chart is range bound, in concert with the monthly chart. Medium term, the chart the chart remains bearish.. Hull MA13 is blue (bearish); Supertrend (1.5/7) is blue (bearish) and the chart is below the 8-Week EMA is heading down (bearish). RSI and CCI are below their mid-lines (bearish) and Stochastic has fallen below its signal line (bearish).

The chart is, however, at the lower end of the range so we'll probably see a move to the upside in the coming week.

The chart shows a trading range in round figures from 7630 to 6930. This week XJO finished at 7075.

Daily Chart.

In the short-term, this chart is looking positive. Indicators in the lower panels have turned up; Hull MA13 and Supertrend (1.5/7) in the top chart are also bullish.

The chart has now formed a higher low, that's half-way to concluding a new up-trend. We still need to see a higher high to complete the criteria for an up-trend.

The daily chart is, thus, out of sync with the weekly chart - that's typical in a range-bound market.

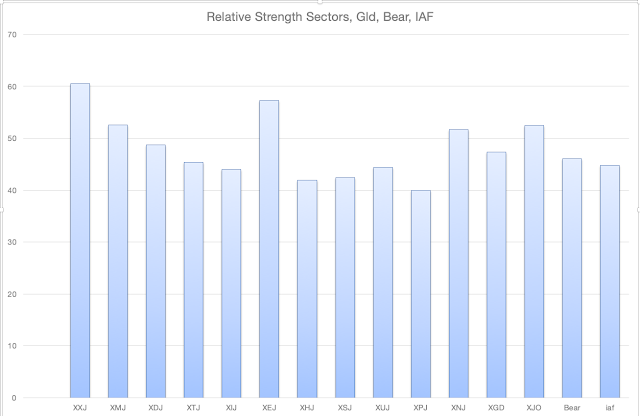

Sector Changes - past week.

This chart shows the performance of each sector (plus Gold Miners, XJO, BEAR and IAF) over the past week.

Pluses and minuses for sectors were evenly spread with six sectors up and five sectors down. Materials (XMJ +3.65%) had a return to form as did Information Technology (XIJ +5.04%).

Consumer Staples (XSJ -3.45%) was the worst after a poor report from Woolworths (WOW -6.08%) and a big fall in URW -7.87% after a big sale of stock under market value.

New Highs - New Lows Cumulative.

NH-NL Cumulative continues to fall and is now well under its 10-Day Moving Average, that's a big red danger sign for long-term investors.

ASX Advance-Decline Line.Like NH-NL Cum, ASX Advance-Decline Line is also bearish, but not as bleak as NH-NL Cum.

It is nudging on its 5-Week Moving Average and another good week would take it over that metric.

% of Stocks above key moving averages.

1. % of stocks above 10-Day Moving Average: Last Week 20%, This Week 74%.

2. % of stocks above 50-Day Moving Average, Last Week 36%, This Week 38%.

3. % of stocks above 200-Day Moving Average, Last Week 33%, This Week 40%

Two out of three are below 50% level - which confirms the bearish status of the ASX. This week's bounce has resulted in a bounce in the shortest term metric. That could be the start of a medium-term trend reversal.

Last week I noted: This is the second week in a row where %Stocks above 10-DMA has been 20% or below. That's another contrarian signal for a short-term bounce. We got that bounce this week.

The above chart compares the performance of XSJ Consumer Staples (yellow and blue candles) with XDJ Consumer Discretionary (blue and grey candles).

If consumers are confident about the economy, they are usually happy to splurge on big ticket, discretionary items - companies such as Harvey Norman, JB Hi-Fi and car retailers. If consumers are not so confident about the economy, consumers tend to delay buying big ticket items.

Conclusion.

1. Weekly and daily charts out of sync - typical of a range-bound market. Traders will play the ranges.

2.. Short to medium term is looking good for further upside. We've probably seen a bottom in the medium-term.

I gave three beaten down stocks as tips last week ALL, REH, JHX.

ALL: Buy at or above 33.06. Stop Loss at 31.64.

REH: Buy at or above 16.00. Stop Loss at 15.02.

JHX: Buy at or above 40.64. Stop Loss at 39.06

ALL triggered a buy on Thursday when it hit 33.06. It finished Friday at 35.17. That's a gain of +6.4% so far. Move stop up to break even at 33.06. Continue to move the stop up if ALL continues rising.

REH triggered a buy stop on Monday at 16.00, but continued to fall the rest of the week. Stop Loss still not triggered. REH is currently sitting on a loss of -3.4%.

JHX didn't trigger a buy stop. No trade. Forget about JHX,

From the two trades, we're sitting on a gain of +3%.