No reports for a couple of days. On Thursday afternoon, my computer "froze" and when I tried to restart it I got the dreaded "black screen", aka the "death screen". I visited the good folk at the Genius Bar, Apple Store, Chermside on Friday afternoon, they got me going again.

Yesterday in Australia.

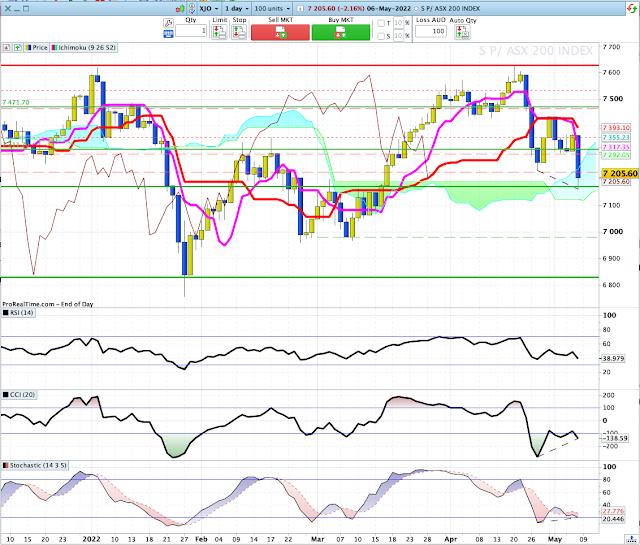

Yesterday, XJO down -2.19%. That's the biggest down day since 24 February, when XJO was down -2.99%.In late December, 2021 and January 2022 the XJO had three down days of more than -2%.

CCI and Stochastic are both showing positive divergences. They don't mean a lot until we get a good upside day. In the meantime, stay defensive.

Overnight in the U.S.

Dow Jones -0.3%. SP500 -0.57%. Nasdaq -1.4%. Small Caps -1.06%. Banks -1.06%.

Indices are respecting the down-sloping 20-Day MA as resistance.

SP500.

Intra-day buying is evident in the long lower tail on the last candle on this chart.

SP500 seems to have found support at Monday's low, so there's a good chance we will see an upside bounce here.

That notion is supported by the positive divergences on the three indicators in the lower panes.

Commodities.

Commodities Index +0.11%. Energy +0.86%. Base Metals -2.37%. Agriculture -1.22%. Gold +0.17%.

Those base metals prices are poor for our miners on Monday. CCI is showing a good positive divergence, so this pull-back might be coming to an end.

New York A-D Line.

NY A-D Line remains in a bear trend. Until that improves, stay defensive.

No comments:

Post a Comment