Sunday, 7 May, Weekly Report.

If you thought this week was crook for the Ozzie Market - you weren't wrong. XJO down -1.22% and nine out of eleven sectors were down.

Weekly Performance of Sectors (plus Gold Miners, XJO and Bonds)

Two sectors up - Utilities +2.05% and Property +1.35%. Both are defensive sectors.

The next two best performing sectors (relatively) were also defensives, Health -0.11% and Staples -0.15%.

Worst performer was the biggest sector in the ASX, Financials (XXJ) -3.42%. XXJ was hit with a double whammy - turmoil in the U.S. banking sector which spilled over to our banks, and then National Australia Bank (NAB) came out with a horror report. NAB fell -6.41% on Thursday and impacted the other big banks. On Thursday. CBA fell -2.57%, ANZ -2.37%, WBC -4.11%. ANZ picked up considerable ground on Friday, up +1.45%, doing much better than the other three big banks.

Momentum.

RSI is a a good guide to momentum. If the daily RSI is weaker than the weekly RSI, then that particular instrument is in danger.

Guide to Momentum:

All three columns sloping up - bullish trend. XPJ.

All three columns sloping down - bearish trend. XXJ, XMJ, XEJ.

Down then up - counter trend bullish rally. XUJ.

Up then down - counter trend bearish pull-back. XDJ, XTJ, XSJ, XNJ, Gold, Composite Bonds (IAF).

The only sector with bullish momentum was Property and Utilities was in a counter trend bullish rally.

STW DAILY CHART.

STW is a tracking ETF for the XJO. I'm using an equivolume candlestick chart. The body of the candle varies in width depending on the volume flowing into the STW on that day. Changes in volume are often related to possible trend changes

In this chart, you can see that when the XJO (STW) was topping in 17-20 April, volume had dried up. Volume drying up at the top of the trend - the Index will fall. It's a bit like a hot-air ballon with the heat turned down - no heat - the balloon will fall.

We can see that on Friday, when the STW was positive, volume was better than the previous two days. Heat turned up - the balloon goes up. STW is likely to rise here. Given events in the U.S. on Friday night, a rise on Monday appears to be a given.

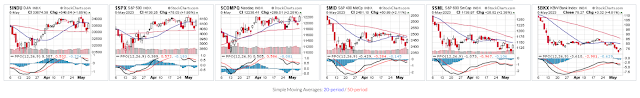

SP500 Daily Chart.

SP500 had a good rise on Friday night, up +1.85% and it finished above the 8-Day EMA and Supertrend has turned bullish.

I would have liked to see better volume on Friday's action, so there may not be a lot of oomph in this move to the upside.

NewHighs and New Lows.

This metric usually trends relatively well, but lately it hasn't known whether it is Arthur or Martha.

The 5-Day MA has been whip-sawing around the 20-Day MA.

This the image of a volatile market. Volatile markets are the enemy of the retail investor/trader.

Stocks/Bonda Ratio.

The Stocks/Bonds Ratio peaked recently on 19 April. Since then it has been in decline and the 5-Day MA is now below the 20-Day MA. X-Overs of the 5-Day and 20-Day have had a good record for predicting further downside in the market. Until a positive cross-over occurs it might be wise to stay defensive.

Conclusion.

So - we're probably looking to a few days on the upside - until the SP500 tests its recent high. Unless we see an increase in volume, that test will probably fail.

The Ozzie market has been under-performing the Americans for a while - but our market has fundamental differences from the American. America pins its hopes on Technology - our market pins its hopes on Commodities. BHP up +4.49% on Friday in America and formed a clear double bottom. Apple up +4.69% on Friday on heavy volume. That's its highest point since August 2022. I'd like to bet on BHP, coming off its lows, doing quite well in the near future. Apple? That's questionable.

Stay safe.