18/3/23. Saturday morning Finspiration Report.

Yesterday in Australia.

XJO had a small rise yesterday +0.41%. It remains just under the 200-Day MA and the 8-Day EMA.

MACD Histogram is flat. Downside Momentum has eased, while the trend remains down. That means we could see an upside move - but not on Monday judging by the U.S. overnight.

Options expiry in the U.S overnight.. Stocks fall on heavy volume.

Dow Jones -1.19%. SP500 -1.1%. Nasdaq -0.74%. Small Caps -2.76%. Banks -5.25%.

Major European banks and regional banks in the U.S. continue to come under pressure.

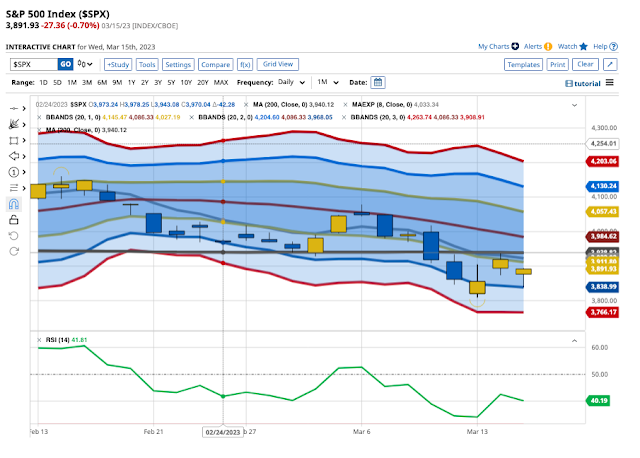

SP500.

SP500 fell marginally back below the 200-Day MA and the 8-Day EMA.

MACD has switched to positive which suggests momentum is back to the upside.

Commodities.

Commodities Index -0.31%. Index -1.49%. Base Metals +0.67%. Agriculture -0.1%. Safe Haven Gold had a big upside spurt, +2.91%.

In the U.S. BHP was flat overnight +0.03% but remains in a steep down-trend, Rio was also flat, -0.09%. Woodside rose, +0.39% but, like BHP, remains in a steep down-trend.

Bitcoin.

Bitcoin was up >8% overnight. It has been above the 8-Day EMA since 13 March. Stay with the trend until otherwise indicated.