16/3/23. Finspiration Thursday Morning Report.

Overnight, more turmoil in European banks slump European and American stocks.

Dow Jones -0.87%. SP500 -0.73%. Nasdaq up marginally +0.05%. Small Caps -1.66%. Regional Banks -1.57%.

American indices were under the pump from the opening after Europe opened well to the down side after a Swiss bank reported problems. Plenty of intra-day buying occurred in America with Nasdaq actually finished on the positive side. I've included Regional Banks today (SVB was a regional bank) because that index is more sensitive to problems in the banking industry. Last night saw heavy intra-day buying in KRX which is a positive, but not necessarily enough to indicate a reversal of the down trend.

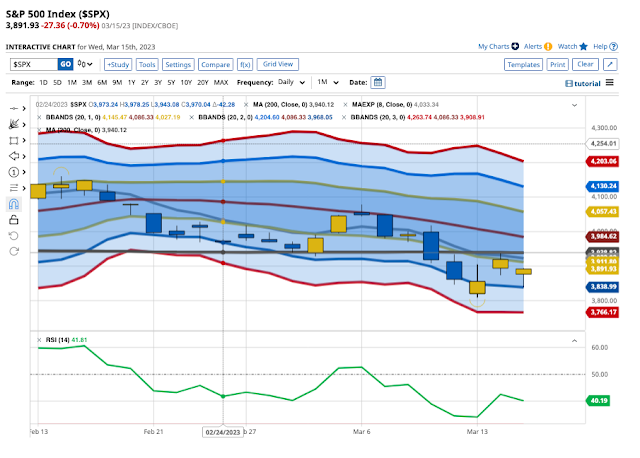

SP500.

SP500 failed at the -1SD and the 200-Day MA. It needs to get back above those two to have a chance of turning bullish. It was, however, above the low of two days ago.

Commodities.

Fear gripped the Commodities market last night, as well as the stock market. That's not a good sign for ASX big resource stocks today.

Commodities -2.33%. Energy -3.95%. Base Metals -2.66%. Agriculture -1.1%. Safe have Gold, of course, went up, +0.78%, but was under intra-day pressure.

Bitcoin.

Bitcoin is consolidating in the upper half of the BBs and remains above the 8-Day EMA. While that state of affairs remains, the short-term trend is up.

No comments:

Post a Comment