Yesterday in Australia.

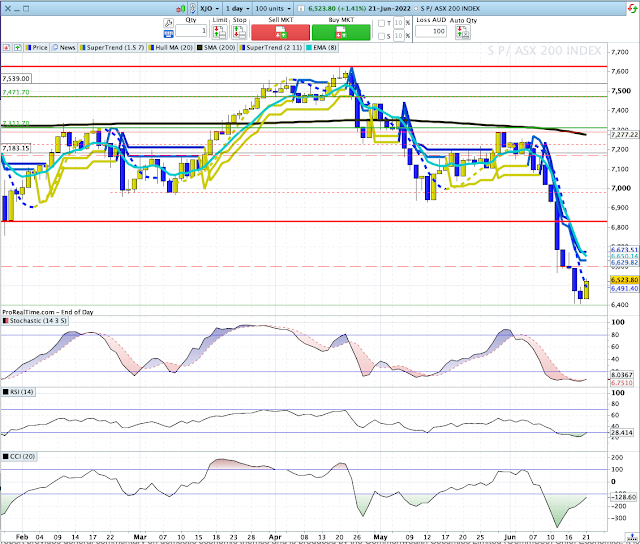

After a weak start, XJO climbed higher to finish up +0.77%.

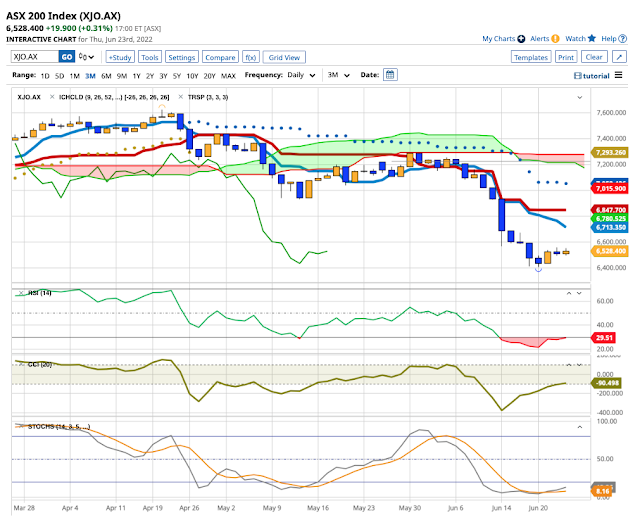

The chart show a short-term buy signal on the Hull MA13.

RSI(14) is back above the 30 level which is another short-term buy signal.

Yesterday saw the best breadth figures for the ASX since early March. Advances 988, Declines 476. Net A-D = 512. 9/3/22 saw a Net A-D of 523. That kicked off a rally which saw the XJO rise by 9% finishing on 21/4/22. I'm not suggesting that we will see something similar this time, but it is promising.

Yesterday's move brings the XJO up to the first line of horizontal resistance and the 8-Day EMA. Given events overseas last night, those two resistance levels will probably be overcome taking the XJO up to the Tenkan Sen (Conversion Line) of the Ichimoku system.

XJO is in a counter-trend rally - until proven otherwise. Until the chart gets back above the Kumo cloud, rallies will probably be sold into at key resistance levels.

Overnight in the U.S.

Dow Jones +2.68%. SP500 +3.06%. Nasdaq +3.34%. Small Caps +3.1%. Banks +4.44%.