24/6/22. U.S. Indices finish higher pushed up in afternoon rally.

Dow Jones +0.64%. SP500 +0.95%. Nasdaq +1.62%. Small Caps +0.84%. Banks -1.35%.

Notice how the Banks fell while Nasdaq rose, that suggests that Bond yields fell (Bonds higher). 10 Year T-Note fell to 3.002%.

SP500.

SP500 could be forming a small H/n/S pattern with Stochastic breaking above 20 - that suggests we will see higher prices in the near future. But SP500 is already running into its first level of resistance. On Ichimoku that's the Tenkan Sen (Conversion Line) and above that is the Kijun Sen (Base Line. Kijun Sen coincides, more or less, with the 20-Day MA. That could be the stumbling block for the SP500.

Conditions remain bearish while the SP500 remains below the Kumo Cloud. Don't expect too much from any rally.

Commodities.

Commodities Index -2.24%. Energy -1.89%. Base Metals -2.57%. Agriculture -3%. Gold -0.61%.

Iron Ore +1.8%. Thermal Coal +1.4%.

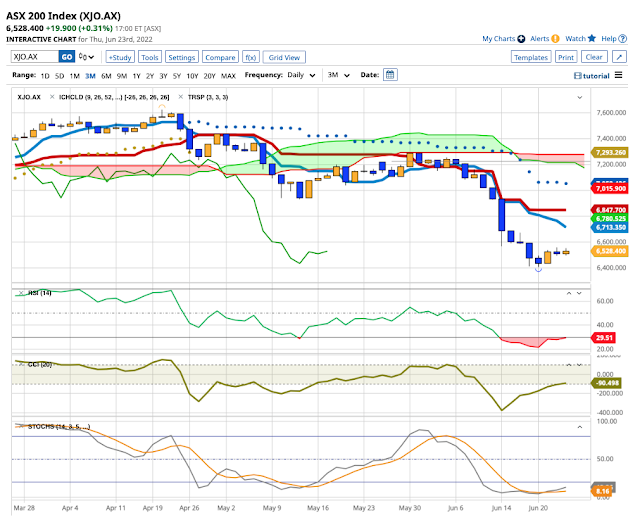

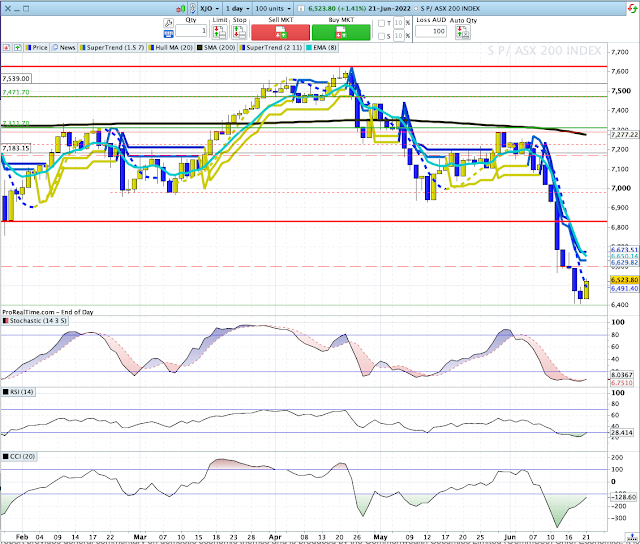

Overnight Oz Futures -0.2%. ASX will probably open flat today.