21/5/22. Yesterday In Australia.

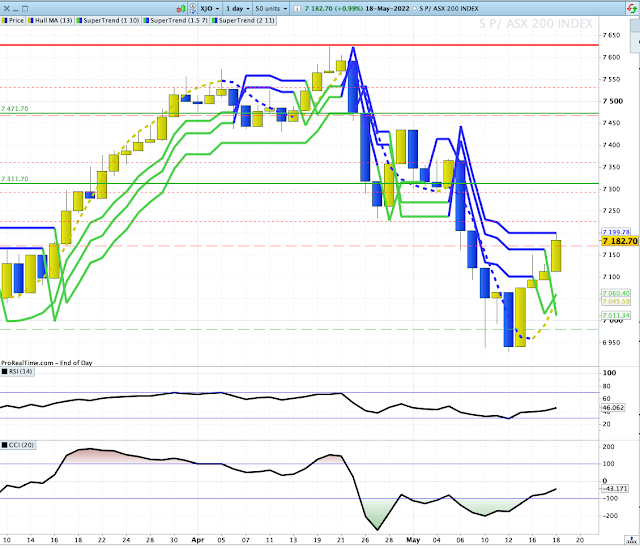

Strong day on the XJO yesterday, up +1.15%. XJO has now formed a higher low. We still need to see a higher high to meet the definition of an up-trend.

Tenkan Sen (Conversion Line - Blue) is now acting as support for the XJO.

Overnight.

Dow Jones +0.3%. SP500 +0.01%. Nasdaq -0.3%. Small Caps -0.37%. Banks -0.06%.Flat finish in the U.S. after intra-day buying erased most of the early buying and producing "hanging man" candlesticks on all of the above indices. That often occurs at or near the end of down-trends.

SP500.

SP500 continues to sketch out a possible bottom for this down-trend. Positive Divergence on CCI gives further optimism to that view.

Any rally is likely to be a counter-trend rally until proven otherwise.

Commodities.

Commodities Index +0.14%. Energy +0.62%. Base Metals +0.31%. Agriculture -0.67%. Gold flat +0.07%.NY Advance-Decline Line.

NY A-D Line remains in a down-trend. Stay defensive until we see this change to an up-trend.