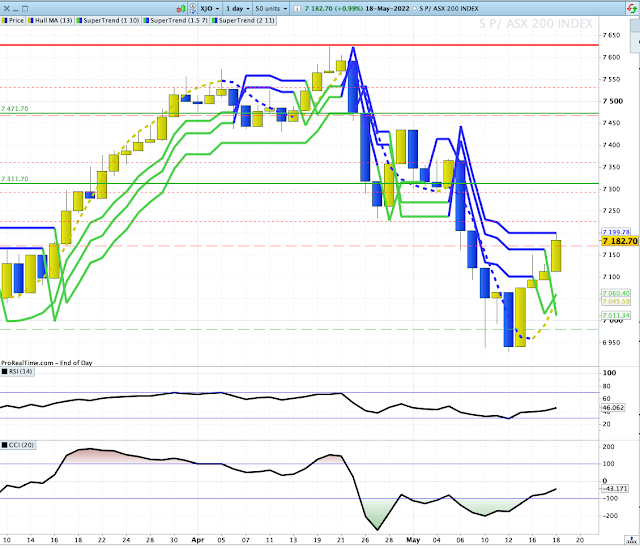

18/5/22. XJO up strongly today.

XJO up today +0.99%. We now have four days to the upside. XJO is now coming up to the last of three Super-trend lines. That might provide some resistance.

In a return to form, Materials (XMJ +2.5%) was the top performing Sector. Consumer Staples (XSJ -1%) was the worst performer and the only Sector to record negative figures.

Here's the XMJ Chart:

The correlation of XMJ and XJO is clear in this chart. XMJ has risen above two Super-trend lines and approaching the third one. That might cause a consolidation or pull-back.

I've calculated a turn-date of 26 May. So we can expect more upside in the medium term, but not before we see some consolidation and then a move to the upside.

Below is a different type of chart suggesting that the current move is a counter-trend rally:

This chart shows the Ichimoku indicators.

XJO has only just moved into the Ichimoku Cloud - that's a neutral or no-trade zone.

We need to see XJO get above the Ichimoku Cloud before being confident of a bullish medium-term trend.

No comments:

Post a Comment