Overnight.

Dow Jones +0.3%. SP500 +0.81%. Nasdaq +1.9%. Small Caps -0.38%. Banks -0.02%.

The Yield Curve remains inverted. 2Yr Treasuries at 2.42%. 10Yr Treasuries at 2.41%.

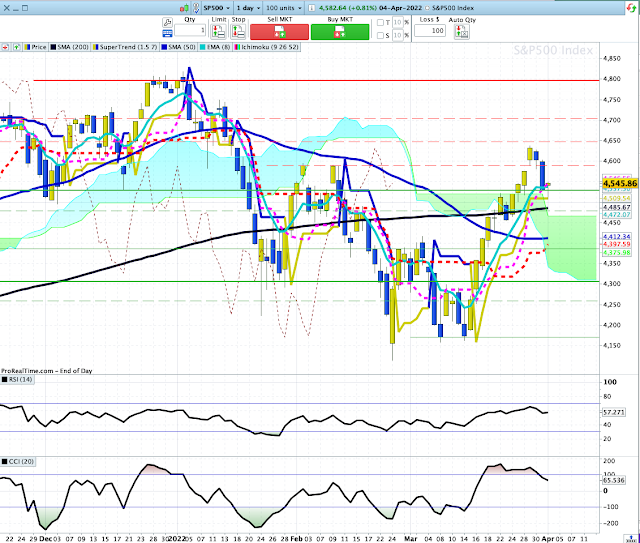

SP500.

Dip buyers came into the market and SP500 shows strong intra-day buying. It has found support at multiple levels: 8-Day EMA, Tenkan Sen (Conversion Line) Supertrend (1.5/7) and top line of the "Cloud".

A strong up-day tomorrow will confirm the resumption of the bull rally.

Commodities.

Commodities Index +1.91%. Energy +2.39%. Base Metals -0.42%. Gold +0.48%.

Iron Ore +1.3%.

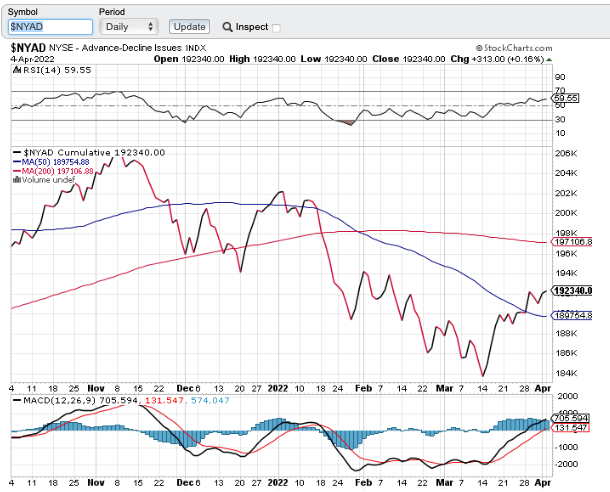

U.S. Advances-Declines Cumulative.

A-D Line remains bullish, but momentum has slowed as indicated by the MACD Histogram which has flattened out. That suggests we could be looking at another pull-back in the near future.

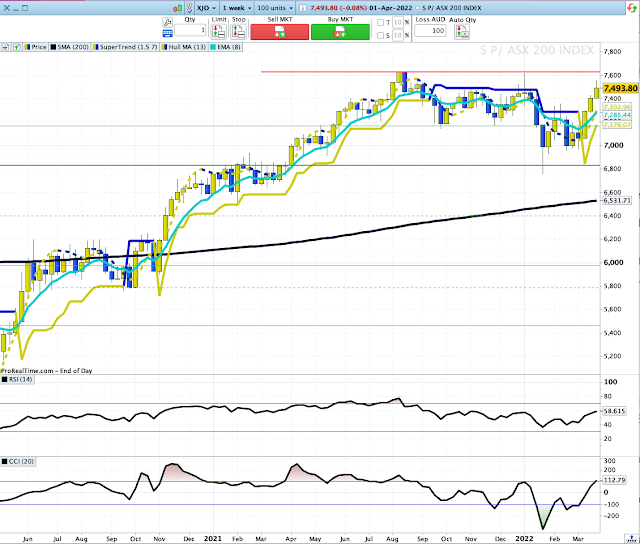

Overnight Oz Futures +0.6% but Oz big miners were down overnight, BHP -0.7% and RIO -1.57%. If that flows through to Australia, it will put a damper on gains in the XJO.