Sat. 27/11/21. Covid's new mutation crashes markets.

A new variant of the Covid virus has emerged in Southern Africa which caused WHO to give it a new designation "Omicron". WHO first described the "Omicron" as a "variant of concern" and said that it could spread more quickly than previous variants.

That was enough to put the bejesus into markets starting with Australia (XJO -1.73%) and Japan (Nikkei -2.25%). Fear then rolled around the globe. Markets in Europe fell heavily, (German Dax -4.15%, UK FTSE -3,64%) and America followed suit (Dow Jones -2.53%, Nasdaq -2.23%). Even more dramatic were falls in commodities. US Oil, for example, fell -13% on fears that countries would lock-down again reducing demand dramatically.

U.S. Markets overnight:

Dow Jones -2.53%. SP500 -2.27%. Nasdaq -2.23%. Small Caps -3.72%. Banks -4.19%.

Safe Haven trading:

Traditional safe havens benefitted from the rampant fear. 20-Year Treasuries rose sharply (TLT +2.53%), Japanese Yen looked good against the US dollar. At one stage in early trading on Friday, USD/JPY was down -1.48%, i.e., Yen up against US$.

Commodities:

Commodities Index -5.96%. Energy -9.6%. Base Metals -3.74%. Gold -0.16%.

Eerie Predictor:

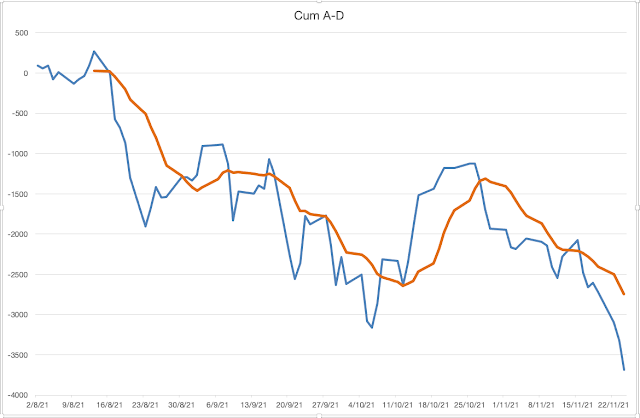

On Wednesday evening I showed the graph of the Australian Cumulative Advances-Declines which showed a dramatic collapse in the Cum A-D. I've said previously that this is probably the best leading indicator for a fall in the market. Two days later, CRASH!

Here's the up-dated chart as of Friday p.m.:

I'll give a more comprehensive up-date on the Australian market tomorrow in Sunday's Weekly Wrap.