Expect consolidation or a pull-back in the near future. Any dip will probably be bought.

SP500 Weekly Chart

The weekly SP500 chart isn't confirming the bullish state of the Australian market. It remains in a down-trend with lower highs and lower lows. Weekly RSI is at 53.69, so it remains below the critical 60 level.

Supertrend Line, 8-Week EMA and Hull MA13 have all turned up. Those are bullish events.

SP500 has come up to the median line of the Andrew's Pitchfork - that often acts as resistance. SP500 also lies beneath the 50-Week MA which may act as resistance.

Until I see a confirmed bull SP500, I'll remain a little cautious about the prospects for the Australian market.

ASX Sector Results for this week.

Six out of eleven sectors were up this week. Materials (XMJ) did the heavy lifting for our market this week, up +4.14%. The prospect of an improving economic situation in China with the possibility of a lifting of strict Covid quarantines probably had something to do with that. But Financials (XXJ) also had a reasonable week, XXJ up 1%. XMJ and XXJ are the two biggest sectors in the ASX. When they both perform well, our market does well.

The big drag on the market this week was Energy (XEJ), down -3.15%. XEJ has been in a medium-term down-trend since August. It is now back to its 50-Day MA, so it is due for a bounce. A decisive break below the 50-WMA could see it back down to test its 200-Day MA.

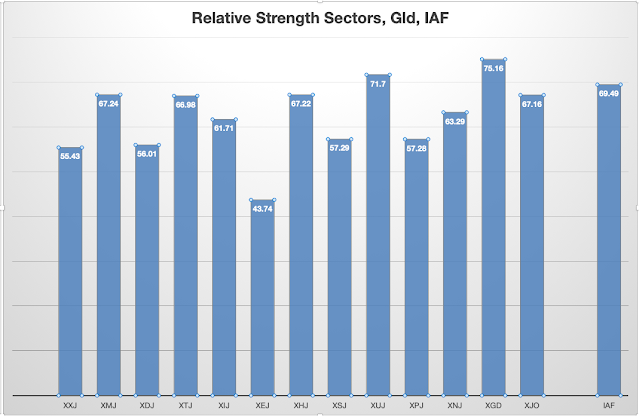

Relative Strength of Sectors.

RSI (Relative Strength Index) is calculated using the default setting of 14 days - almost three weeks of trading. It provides a more reliable guide to changes in sectors than the one-week results which can jerk around quite a lot and, thus, RSI is probably a better guide to recent strength in the sectors. (Click here for a description of RSI.)

Last week, nine out of eleven sectors were above the 60 level - a very bullish result. This week, that has fallen to six out of eleven sectors are above the 60 level, so breadth has dropped off a little this week. Only one sector (XEJ) is below the 50 level - so we still have a broad based bullish market, but easing a little.

XJO is just above the 70 level - expect a pull-back in the broad market.

NewHighs-NewLows Cumulative.

This is a lagging indicator but bullish signals are usually highly reliable.

This is a metric for the long-term investor. NH-NL Cumulative has hit right on its 10-Day MA this week. A move above that level would be a signal for long-term investors to go long.

I've developed another metric StrongStocks-WeakStocks which is similar to NH-NL but gives signals a little earlier than NH-NL.

SS-WS is up for the fourth week in a row and has moved well above its 5-Week MA. Four weeks in a row is a strong bullish result.

% of Stocks above key moving averages.

1. % of stocks above 10-Day Moving Average: Last Week 75%, This Week 64%.

2. % of stocks above 50-Day Moving Average, Last Week 86%, This Week 85%.

3. % of stocks above 200-Day Moving Average, Last Week 58%, This Week 60%.

Both the medium-term (%stocks above 50DMA) and long-term (%stocks above 200DMA) measures are bullish. The short-term measure (%stocks above 10DMA) has pulled back a little this week as a result of Friday's big fall. At 64% it remains bullish.

% of stocks above the 200-Day MA rose again this week. It has been rising since mid-September. Steady improvement can be seen in the bar chart and the 5-Week MA is rising. This suggests we'll see 80% before we get a major pull-back.

Conclusion.

ASX had another positive move to the upside this week. RSI hit well above 70 on Thursday - which is overbought. That, and other indicators, suggest we could see a pull-back in the next week or so. Any dip is likely to be bought given the strong basics of our market.

No comments:

Post a Comment