This is heavy duty analysis this week. Try to stay with it to the end.

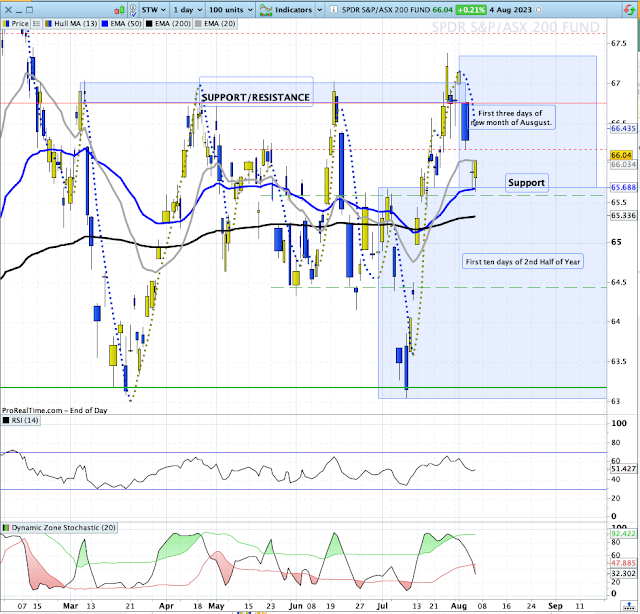

STW Daily Chart. (STW is a tracking ETF for the XJO)

(The above chart is a Candle/Volume chart. The volume is indicated by the width of the candle. This allows a viewer to see the relative volumes entering the market. The height of a Candle/Volume is the same as a normal candle.)

On 27 July, STW broke above the old Support/Resistance zone which had played a part in the XJO for a few months. That upside break proved to be a false break and the Index fell back through the zone on heavy volume on 2 August.

Various theories exist relating to range trading:

1. If the range of the first 10-Days trading of the new half-year, is exceeded - then that should provide direction for much of the half year.

2. If the range of the first three days trading of a new month is exceeded - that then should provide direction for the first half of the new month.

I've marked these two ranges on the chart.

The top of the 10-day range occurred on 4 July. The Index broke upwards from the 10-Day range on 14 July and then broke above support resistance.

The first three days of August fit exactly above the first ten days of the second half of the year. So there was a break-out from the 10-Day range.

On Thursday, 3 August came back down to test the top of the 10-Day range for the new half year. It then bounced to the upside on Friday.

The 10-Day range remains intact and the break-out from this range remains intact.

A fall back into the 10-Day range is likely to see a test of the low of the 10-Day range which occurred on 10 July.

The high of the 10-Day range and the low of the three-day range also coincide (more or less) with the 50-Day MA. So that level is clearly important for the market.

The market is at an inflection point.

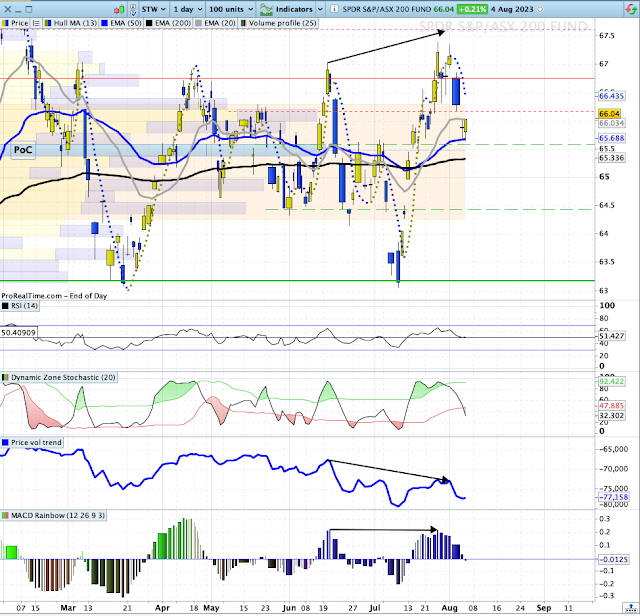

Daily STW with more Volume information.

This chart adds more weight to the idea that the STW is at an inflection point. That level coincides with the "Point of Control" (PoC) shown in the Volume Profile on the left of the chart. Point of Control is the level on the chart where the most volume has traded. PoC tends to act as a magnet for the chart and that's more or less where the chart landed this week then bounced.

So we have a number of important levels in confluence.

1. Top of the 2nd Half 10-Day range.

2. Bottom of the new month 3-Day range

3. Horizontal resistance.

4 Volume Profile's Point of Control.

The pull-back in the 3-Day range at the beginning of August was well signalled by negative divergences on the Price Volume Trend and the MACD Histogram. Unless there is a sudden improvement in the market at the beginning of the coming week, we can expect more downside as the confluence of supports gets broken.

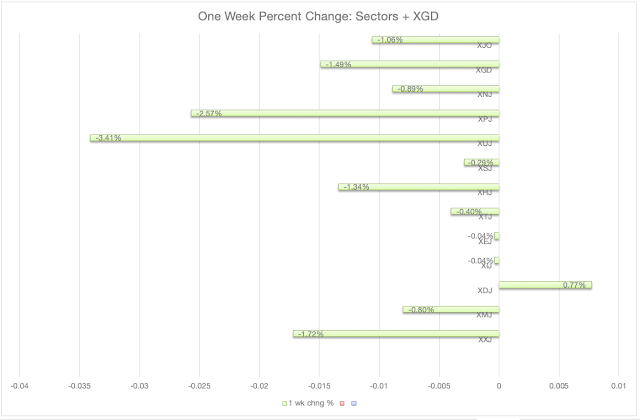

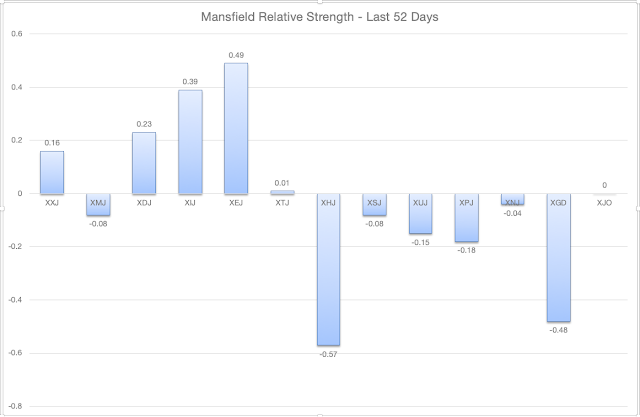

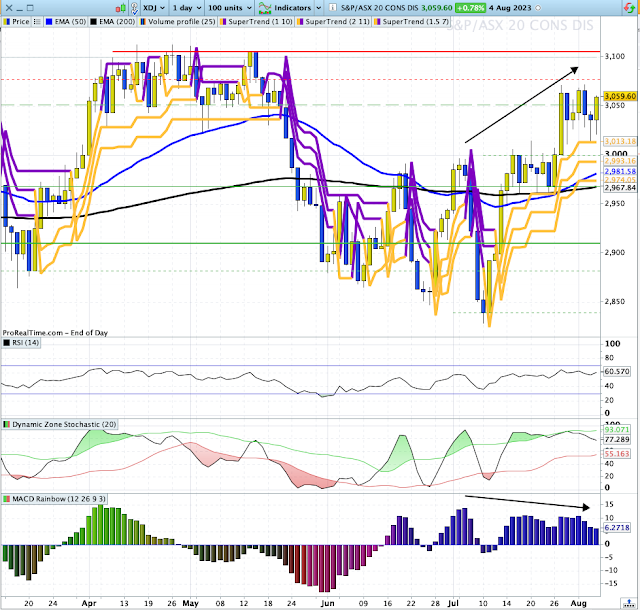

Sector Performances this week.

XJO was down -1.06% this week and ten out of eleven sectors were down.

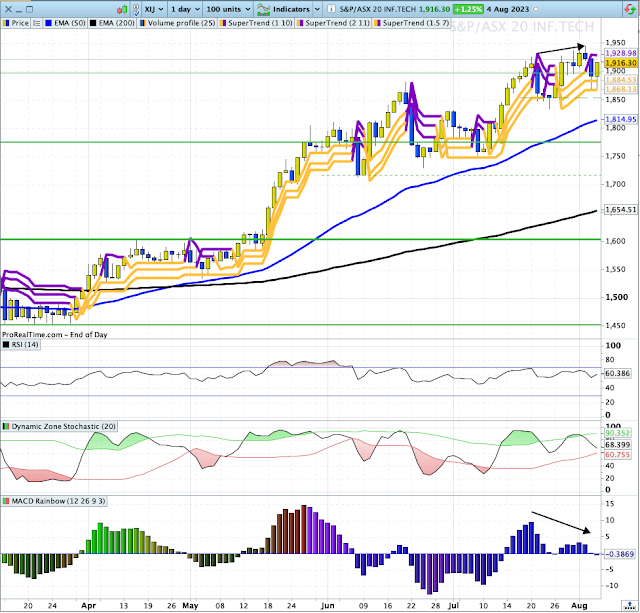

The only positive sector was Discretionary +0.77%. The next two best performers (relatively) were Information Technology and Energy, both down marginally -0.04%. That's interesting as those three sectors are all Cyclicals. We expect Cyclicals to perform poorly in a falling market and Defensives (Health, Utilities and Staples) to perform best. What's going on? Beats me.

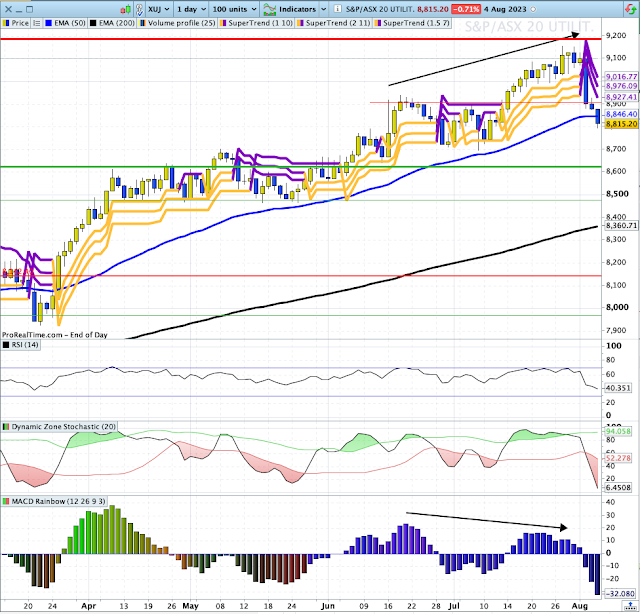

XUJ is particularly interesting as it has been one of the best performing sectors in recent months, but its run-up looks like it has finished.

XUJ is on a triple Super-trend sell signal and is below its 50-Day MA for the first time since 27 March. Now it is oversold on Stochastic at 6.45 so it might bounce here - and prove me wrong.52-Day Relative Strength of Sectors.

Mansfield Relative Strength measures the performance of an item against the performance, in this case, of the XJO over the past 52 Days.Interestingly, the three best performers over the past 52 days were also the best performers over the past week: XDJ, XEJ and XIJ.

Conclusion.

That's all from me this week. I'm not feeling confident about the near future of our market.

It is at an inflection point, but the weight of evidence suggests a fall into the 10-Day Range at the beginning of the 2nd Half of the Year. Not a good prognostication.