Overnight in the U.S.

Dow Jones -1.07%. SP500 -0.79%, Nasdaq -0.82%. Mid Caps -1.07%. Small Caps -1.46%. Banks -1.57%.

SP500.

SP500 opened with a big gap down following big down-side moves in Europe and the East on Thursday.

Plenty of intra-day buying limited the degree of the fall.

Gaps on the 20 June and 30 June have now been closed. The gap above Thursday's candle remains open. Gap Theory says that all gaps must close (eventually).

Despite the big movement last night, the SPX remains in an up-trend - above the 20-Day MA which is still heading up. MH40 remains up and the single Supertrend Line I have on the chart remains up.

Supertrend and 20-Day MA could provide support.

Commodities.

Commodities Index -0.22%. Energy -0.18%. Base Metals -0.11%. Agriculture -0.09%. Gold -0.3%.

Last night's candle on Energy shows an exceptionally long lower wick - evidence of lots of intra-day buying. Watch for a break above horizontal resistance which is not too far over-head. Such a break should see a big move to the upside.

Gold is showing a strong positive divergence on its CCI - it could also be setting up for a big upside move after its long bearish fall.

After 40 minutes in Australia, XJO is down -1.65% but off its lows. This could erase more of the big opening move to the downside.

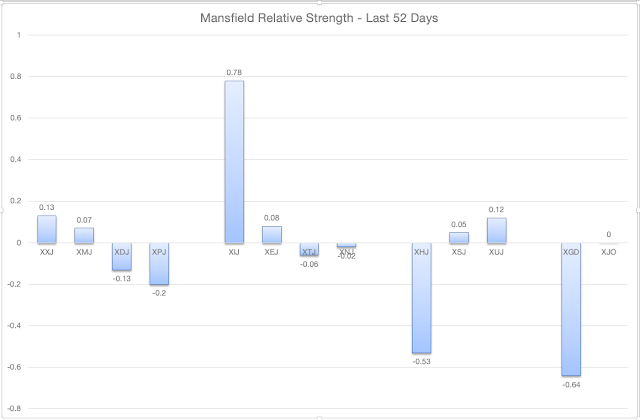

All eleven sectors are negative with Energy down 2.15% (worst). Watch for a move up from here in XEJ.