XJO rose today +0.59%. It broke above horizontal resistance and the 20-Day MA. That's a show of confidence given that the RBA will announce ints interest rate decision tomorrow.

Materials (XMJ) was the best performing sector today, up +1.08%, just nudging ahead of Utilities (XUJ) up +1.05%.

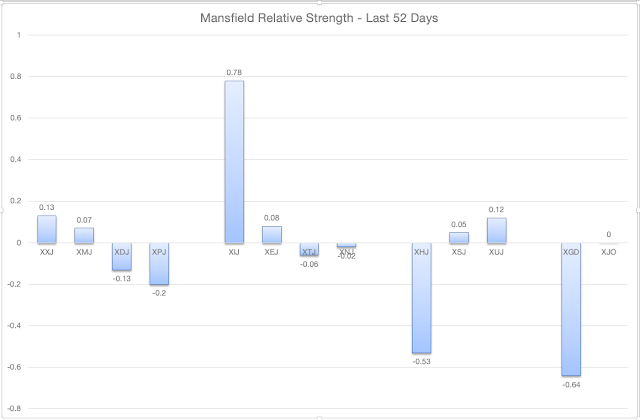

My favoured sector XIJ was down today -1.45%. That suggests that the big punters think we'll see an interest rate rise tomorrow. Stocks in Info,Tech. tend to be heavily leveraged and unduly impacted by interest rate rises. We'll have to see tomorrow.

Today's candle was a bearish engulfing candle but the Index remains in a medium term up-trend. We need to see more evidence before thinking that the up-trend in XIJ is over.