The Old Geezer might be right, but inflation does seem to have peaked back in December, 2022. It still has a way to fall before being normalised, but it does seem to be falling. Just maybe, the RBA won't be too far off ending rate hikes.

XJO Daily Chart.

The trend remains down. Last Monday, XJO hit the top of the Standard Error Channel. On Tuesday, the ASX was mugged by the RBA rate increase, and the XJO remains solidly within the down-trend. It is now sitting at the 200-Day Moving Average where it has bounced before. Until we see a significant break of structure by setting up a higher high and higher low, we have to presume the down-trend remains in place. We need to see a close above Monday's high and above the 50-Day MA to feel that a new uptrend is in place.

The chart finished Friday at the centre of the down-trend channel and RSI is sliding sideways, so there is a chance for our market heading upwards.

American SP500.

In the first half of 2022, XJO formed a Head-and-Shoulders formation which reached its culmination in just one week in the middle of June.

Sector Performance this past week.

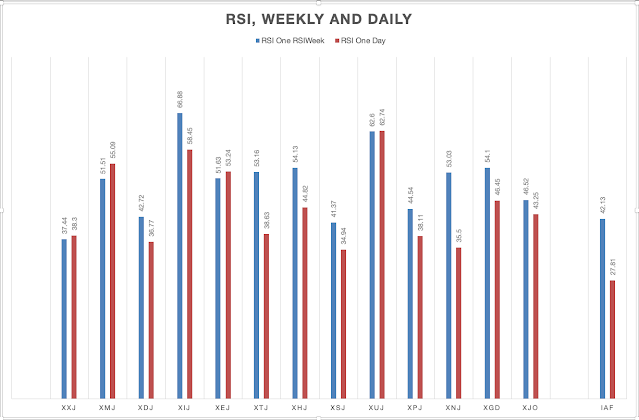

XJO was down a little this week -0.32%,but, only three sectors were up: Materials (XMJ) +2.05%. Utilities (XUJ) +1.13%, and Energy (XEJ) +0.44%.

Conclusion.

The Australian market has been in a down-trend since mid-April. That's in stark contrast to the American market, buoyed by rampaging tech stocks, which has been in an up-trend since mid-March.

Stay cautious until we can see a definite change in the trend from down to up.

The Australian market is closed on Monday for the King's Birthday holiday held in most of the Australian states (except Queensland an WA.)