Despite all the hoo-ha about the U.S. Debt Ceiling in the media, not much movement occurred in the Oz market this week. But, the media got its action on Friday night when the Dow Jones rose +2.12%, US Mid Caps rose +3.27%, U.S. Small Caps +4.06%.

Oz market will almost certainly follow to the upside on Monday

Let's get into the details.

XJO Daily Chart.

The chart remains in a down-trend. On Wednesday and Thursday it hit the lower edge of the Standard Error Channel then bounced on Friday back above the 200-Day MA. That's encouraging for the bulls but the chart needs to close Monday's high (circled) and get above the 50-Day MA (blue dotted line).

Until we see a significant break of structure by setting up a higher high and higher low, we have to presume the down-trend remains in place.

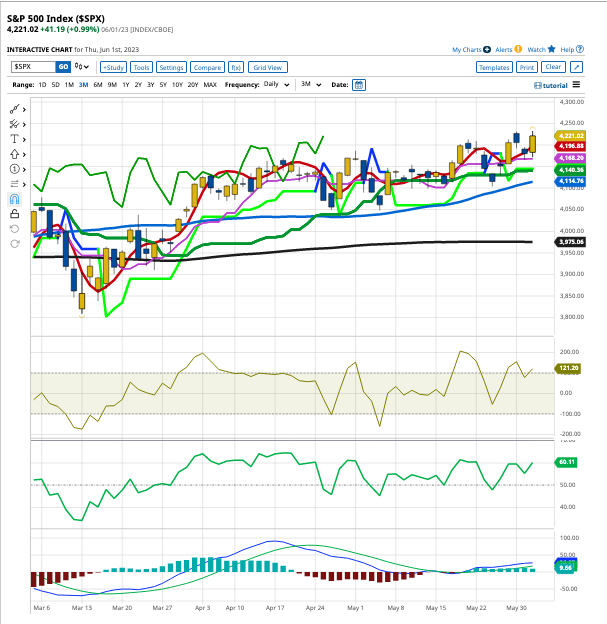

American SP500.

Unlike the Australian XJO, the American SP500 is in a strong up-trend. Friday's night action broke above its restraining up-trend line. Friday saw the SP500 up +1.45%

Just above the high of Friday is a major horizontal resistance level which was set back in August, 2022. That might cause the SP500 to stutter.

CCI shows a negative divergence suggesting we might see a pull-back in the near future.

Sector Performance this past week.

XJO was down a little this week but -0.14%, as usual, we had a wide variation in sector performances.

Sector Momentum.

A quick way to check momentum is to look at the difference between weekly and daily RSI. If daily RSI is below weekly RSI, then momentum is negative, or bearish. Vice versa, if daily RSI is above weekly RSI, then momentum is positive or bullish.

The above profile is indicative of a bearish market. Only two sectors are showing positive momentum, XIJ and XEJ. XXJ is flat, so it could be about to turn around from its current poor performance (see above).

Look to strong stocks in sectors with positive momentum.

Conclusion.

The Australian market has been in a down-trend since mid-April. That's in stark contrast to the American market, buoyed by rampaging tech stocks, has been in an up-trend since mid-March.

No doubt we will see a big upside move on Monday, but, until we see more sustained moves to the upside, doubts must remain about the Australian market.