20/5/23. Saturday Morning Finspiration Report.

In Australia yesterday.

XJO up yesterday +0.59%. The daily candle finished at horizontal resistance from 8 May.

Yesterday's candle finished marginally above the Base Line of the Ichimoku System. (Base Line, black, is the mid-point of the last 26-periods.).

The Conversion Line remains below the Base Line. (Conversion Line, blue, is the mid-point of the last nine periods.). We need to see the Conversion Line above the Base Line for a bullish context.

Overnight in America.

Dow Jones -0.33%. SP500 -0.14%. Nasdaq -0.24%. Mid Caps -0.89%. Small Caps -0.74%. Regional Banks -1.76%.

Regional Banks came into focus again last night after U.S. Treasury Secretary, Janet Yellen, said more mergers might be necessary.

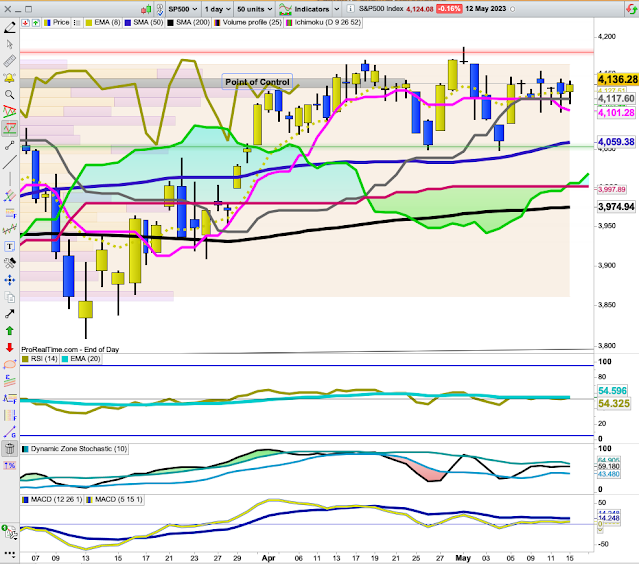

SP500.

SP500 is at the top edge of an upscoping bearish wedge. Watch for a fall back to the lower edge of the wedge. A break lower would be bearish.

Sucker Rally?

To check if the current upside move is a "sucker rally" I'm looking at the NYSE Advance-Decline Line.

Comparing the NYAD Line with the SP500 we can see that NYAD is showing a negative divergence from the SP500 - so - yes, this probably is a sucker rally.

Here's the chart for QQQ (ETF for Nasdaq).

Since early May, QQQ (Nasdaq) has been in a very strong up-trend.

Here's the Advance-Decline Line for Nasdaq:

NAAD is in a negative diversion from Nasdaq and at the lower end of its daily chart. That's in marked contrast to Nasdaq which is now way up at the top of its chart - and overbought.

The only conclusion that can be drawn is that the market has been dragged up by a few large tech stocks. That's a precarious position to be in for the market.

Gold.

Gold came roaring back to life last night, up +0.99% after being in a short-term down-trend since 10 May. It still has work to do to prove its bullish credentials, but it does look promising.