7/4/23. Friday Inspiration Report.

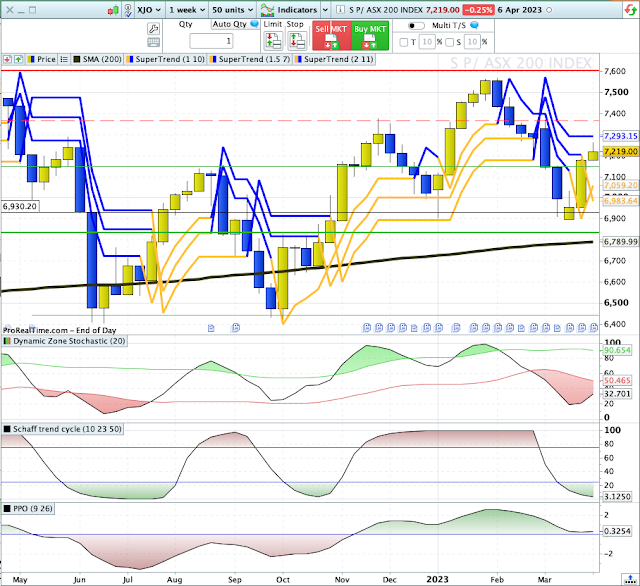

Yesterday in Australia, XJO had a modest fall.

XJO down -0.25%.

The index is hovering around horizontal minor resistance at 7226. That's also at the 50% retracement of the fall from 6 Feb. to 21 Mar. That could signal the start of a pull-back.

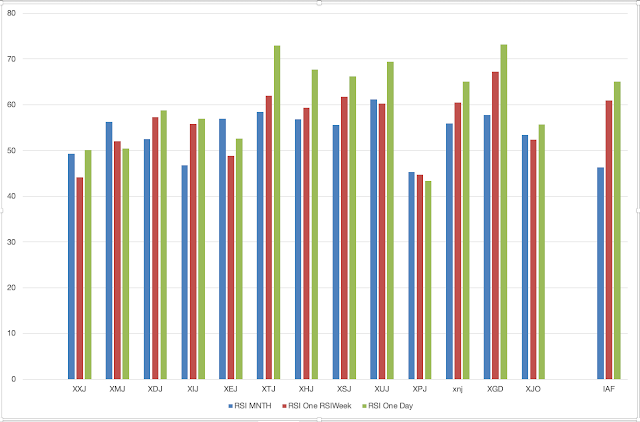

For now, the chart remains bullish. Indicators (RSI and Stochastic) have turned down but not yet signalling a "sell".

If we do get a pullback, a significant horizontal support lies at 7150. XJO is currently at 7219.

Overnight in the U.S.

Dow Jones flat +0.01%. SP500 +0.36%. Nasdaq +0.76%. Small Caps flat +0.02%. Banks +1.05%.

SP500.

SP500 has bounced up off horizontal support at 4000 (round figures). That suggests that the current pull-back is over. Look now for a test of major resistance at 4177, that's the high from 2 Feb.

Commodities.

Commodities Index -0.29%. Energy -0.61%. Base Metals +0.15%. Agriculture +0.98%. Gold -0.71%.

The double doji on Base Metals suggests that the current pull-back may be over.

U.S. has another session of trading before our market re-opens on Tuesday.

Bitcoin.

Bitcoin was down -0.49% overnight. It remains in a long sideways consolidation. Support and resistance are clearly indicated on the chart. Wait to see which way this breaks.