5/4/23. Wednesday Morning Finspiration Report.

Overnight in the U.S.: Major Indices down.

Dow Jones -0.59%. SP500 -0.58%. Nasdaq -0.52%. Small Caps -1.98%. Banks -1.97%.

SP500.

SP500 chart shows a bearish engulfing candle so we will probably see more downside.

So far, no real damage has been done technically. The chart is sitting on the 3-DEMA and above the 8-DEMA. DZStochastic remains above the sell line but turned down. Schall Trend Cycle remains above its sell line. Wait for definite signals.

Commodities.

Commodities Index -0.12%. Energy -0.38%. Base Metals -1.5%. Agriculture -0.49%. Gold +1.86%.

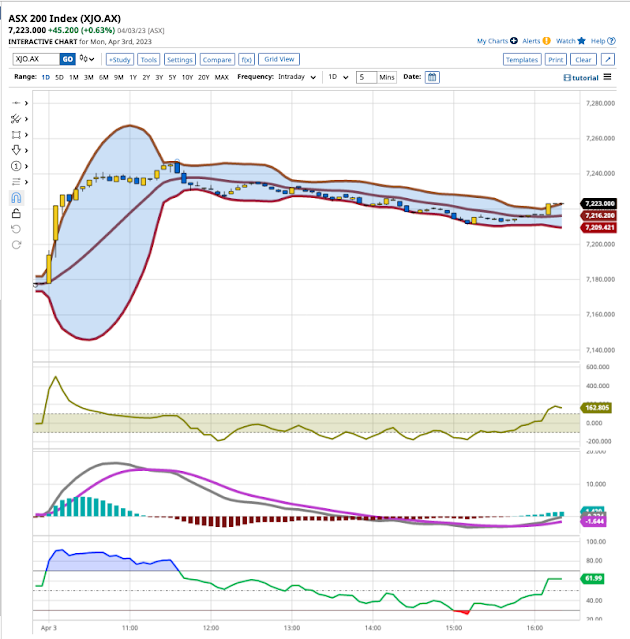

After an hour's trading this morning, XJO is flat +0.05% after being up in the first half-hour.

Bitcoin (USD)

BTC remains in a wide consolidation pattern. Indicators (DZStochastic and Schaff Trend Cycle) are on short-term "sell" signals.

Notice, however, that the bands on DZStochastic are narrow so it wouldn't take much to flick this into a bullish configuration.

Until horizontal support is broken, this remains in a sideways consolidation. Wait.