4/4/23. Tuesday Evening Finspiration Report.

Reserve Bank Interest Rate Day - A Fizzer?

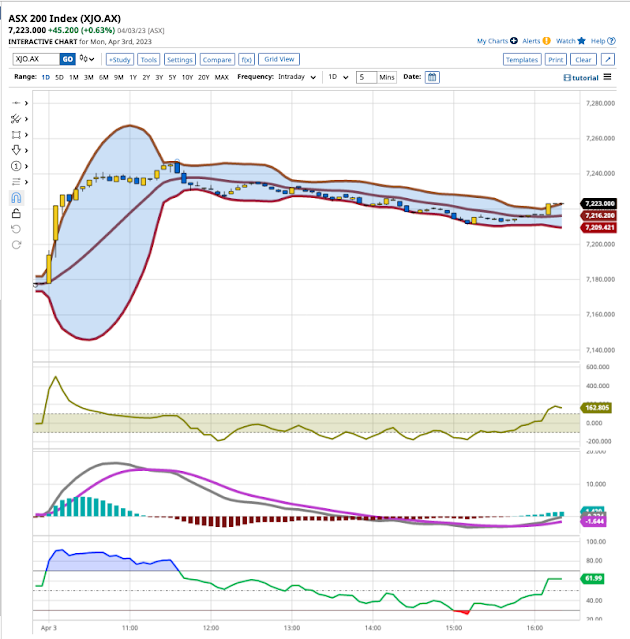

XJO finished higher today - up just +0.18%.

Interest Rate Day often produces some sharp movements in the market - but not today. After the "No Change" announcement, XJO did move higher but not much, up 14 points or +0.19%. That's not a lot compared to what it can do on IRD.

Notice how the XJO moved up in the five minutes before the interest rate announcement. Somebody (or somebodies) seems to have pre-empted the IR announcement. I suspect it occurred while there was some unseen selling going on in the background - two bob each way. If it goes down, the punter/s exits the buy side and let the sell side cascade down. If it goes up - exit the sell side and enjoy the ride. Remember that HFT Algorithms react in a milli-second, and large institutions act within one second. No retail trader can hope to compete in these sudden changes in direction.

Nine out of eleven sectors were up today. A big hit was taken by XMJ (Materials), down -0.9%. BHP, the largest stock in that sector, was down -2.2% today.

Best sector was Energy, up +1.3%. It got a push higher from oil price rises overnight - as a result of cuts by OPEC to their output.

Here's the XMJ Chart:

XMJ finished the day below the Short-Term Line (3-DEMA) but remains above the 8DEMA (dashed line). A finish below that would be short-term bearish.