3/4/23. Monday Evening Finspiration Report.

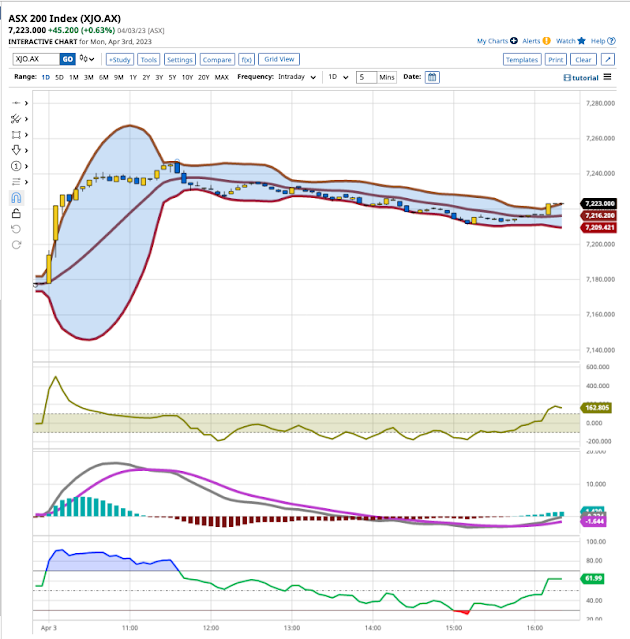

XJO finished up today +0.63%.

The index rose strongly until about 11.30, then slowly declined until about 3.15 p.m. A sluggish counter-trend rally then lifted the Index a little into the close. The sell-off was probably due to nervousness about the pending interest rate announcement. (See below.)

XJO on the daily chart is now at an obvious horizontal resistance level. Given the intra-day selling we saw today, we may see a pull-back here. Any dip will likely be bought.

Nearly all sectors were up today except Materials which was up >7% last week so it was probably due for some weakness.

Despite today's fall, XMJ remains in a strong up-trend and is still ahead of the Short-term Line (3-DEMA) and the important 8-DEMA (dashed line).

Fun and games tomorrow when the Reserve Bank meets and announces its interest rate decision. No clear consensus exists amongst the pundits about the possible out-come. Up? Down? No Change? Take your pick. Better still wait and see how the market reacts tomorrow after 2.30 p.m.