31/3/23. Friday Morning Finspiration Report.

U.S. stocks rise again. Nasdaq "officially" in bull market.

Dow Jones +0.43%. SP500 +0.57%. Nasdaq +0.73%. Small Caps -0.09%. Regional Banks -2.03%.

Nasdaq is up 20% from its lows which puts it into bull market territory.

While the media has been focussing on the "bad news" in the banking industry, technology has been leading the charge into a new bull market.

SP500.

SP500 has now pushed above the Keltner Channel. It looks like it's "buy the dips" time again.Commodities.

Commodities Index +0.73%. Energy +0.75%. Base Metals flat 0.00%. Agriculture +0.94%. Gold +0.9%.

After nearly 30 minutes of trading this morning, XJO is up +0.7%

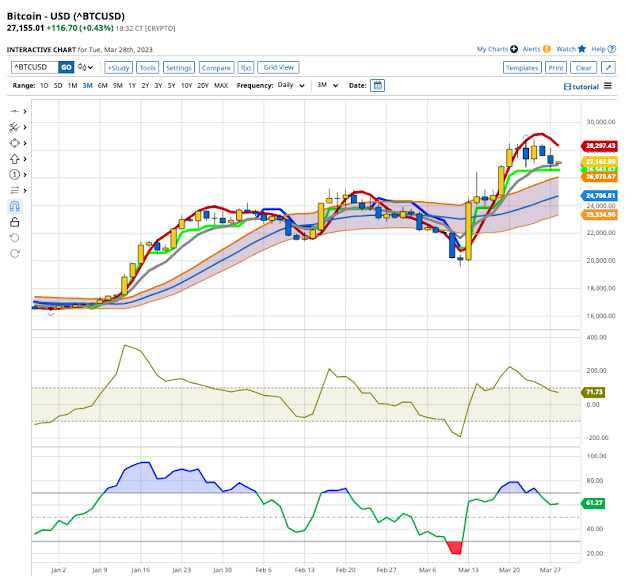

Bitcoin.

Last night, Bitcoin fell -0.8%. During the night session it hit a new 52-week high. Stay with the up-trend.