11/3/23. Finspiration Saturday Morning Report.

From CBS: California regulators on Friday abruptly shuttered Silicon Valley Bank, closing a 40-year-old financial institution that catered to the tech industry and that was the 16th largest U.S. bank before its sudden collapse. The company's stock tumbled 60% on Thursday and had plunged another 70% on Friday before trading of its shares was halted. Read more here.

Yesterday in Australia:

Finally, and it gives me no joy to say this, XJO is down to my preferred support zone which I had touted previously for some time.

XJO could fall a little further before a snap-back rally might occur.

XJO down very heavily on Friday -2.28%.

Overnight in the U.S.

Dow Jones -1.07%. SP500 -1.45%. Nasdaq -1.76%. Small Caps -2.5%. Banks -3.91%.

Last night's candle on the Bank Index finished in the middle of its wide range - but suggests that a lot of indecision remains concerning the Banks.

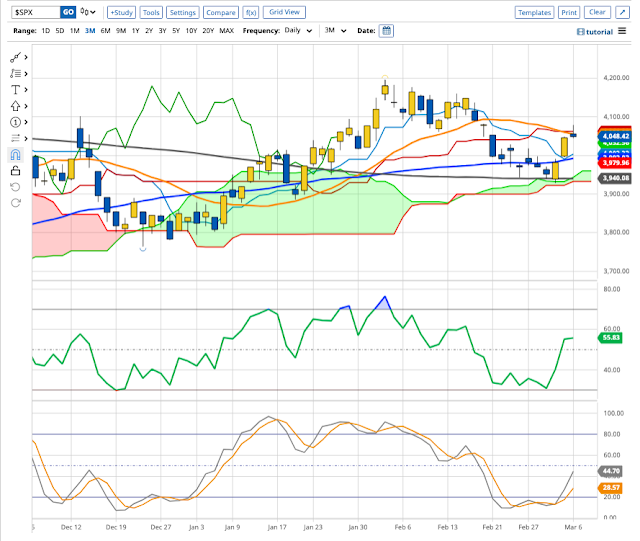

SP500.

Sp500 is down to an old congestion zone from late December to early January. That congestion zone is likely to provide support. But we could see a deal of shuffling in the SP500 before an upside move can begin.

Commodities.

Commodities Index +1.07%. Energy +1.39%. Base Metals -0.3%. Agriculture +0.4%. Gold +2.16%.

Gold has been a major beneficiary of the uncertainty resulting from the crash of SVB.

Overnight in the U.S., BHP was down -1.02% after lifting in early trading.

BHP is now down to horizontal support from the lows of late-February.

Indicators are showing possible positive divergences which suggest the falls are coming to an end. Look for a bullish engulfing candle to confirm.

Bitcoin.

On Friday in the U.S., Bitcoin was down just -0.77% and is now showing signs of rebounding to the upside. I'd like to see more upside and a cross above the 8-Day EMA before being sure that this is the end of the plunge in Bitcoin, but it is looking promising.