9/3/23. Inspiration Thursday Evening Report.

XJO finished flat today after falling from highs around 3.00 p.m.

XJO finished up just +0.05% today. The intra-day sell-off in the last hour is sometimes an indication that our market things the overnight results will be poor. Today's doji candle-stick indicates indecision.

Today's action was weighed down by some big stocks going ex-dividend. BHP fell -2.2%, Rio -2.9% and CSL -2.2%.

Myer was a screamer today, up +18.3% after giving out a good half-yearly report.

Some of the big banks did well today, ANZ +0.7%, WBC +1.2% and NAB +1.5%. About a week ago I noted that the banks were exceedingly over-sold and to watch for a rebound. That's coming good now.

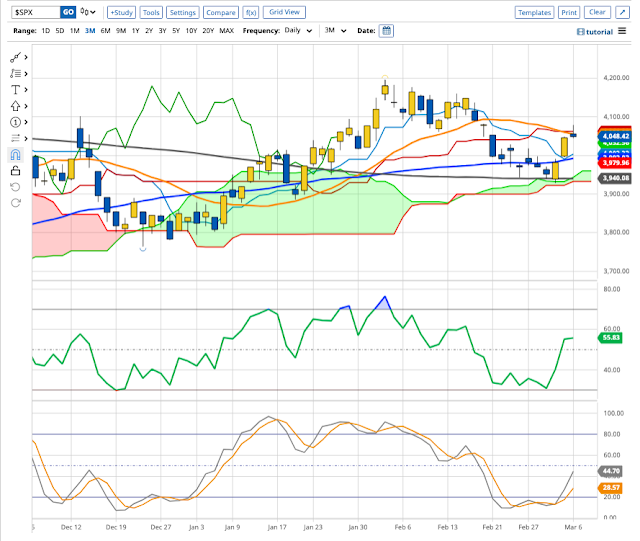

Financials (XXJ) chart:

XXJ is back above its 8-Day EMA and Supertrend turned bullish back on Tuesday. The trend is looking good in the short-term.

In early trading in Europe STOXX down -0.35%.

Dow Jones Futures showing -0.05%, while Nasdaq Futures are down -0.35%.