21/2/23. Finspiration Tuesday Evening Report.

It was BHP Day today on the ASX. It reported before the market opened and fell once trading began, to be down around -2%. But later in the day, buying came into the stock and that led BHP and the ASX to finish with small losses for the day.

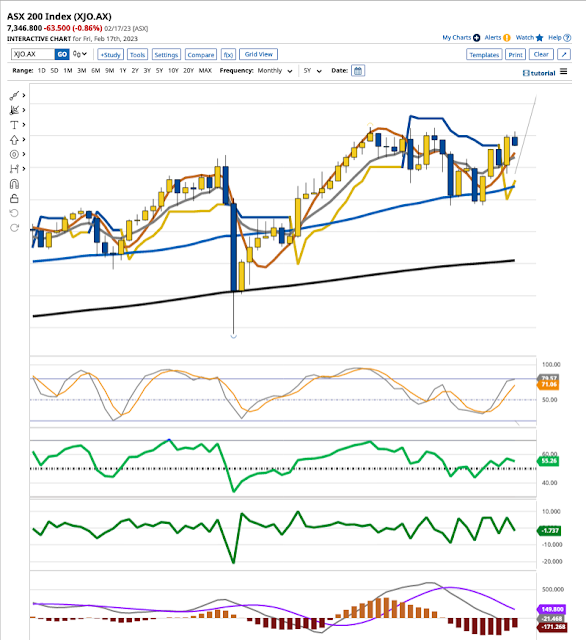

First: XJO.

The XJO was down -0.21% today. The long lower wick on today's candle shows the extend of the intra-day buying.

The past todays show doji candle-sticks - indecision. Coming at the low end of a down trend that could be signalling the end of the trend. We need to see a bullish candle and a break above the 8-DEMA. That's the down-sloping grey line which has provided resistance since 9/2/23.

BHP:

BHP finished down -0.33% but finished up well above its opening price. It has nudged back into "No Man's Land" and marginally above the 8-Day EMA. That is looking positive.

Coles also reported before the market opened. It did the opposite of BHP. Up at the opening and then sold off.

COL remains in the top half of the Bollinger Bands (bullish zone) but today's wide ranging bearish candle looks ominous. I'm expecting more downside for COL.The U.S. reopens tonight after Washington's Birthday Holiday.