12/11/22. Finspiration Morning Report.

Overnight stocks extend rally. Commodities rise. Bitcoin pulls back.

Dow Jones +0.1%. SP500 +0.92%. Nasdaq +1.88%. Small Caps +0.56%. Banks +1%.

SP500.

SP500 is in an up-trend from mid-October. It seems headed for the 200-Day MA. (DJ is already over that level.)

We are now in a buy-the-dips scenario.

Commodities.

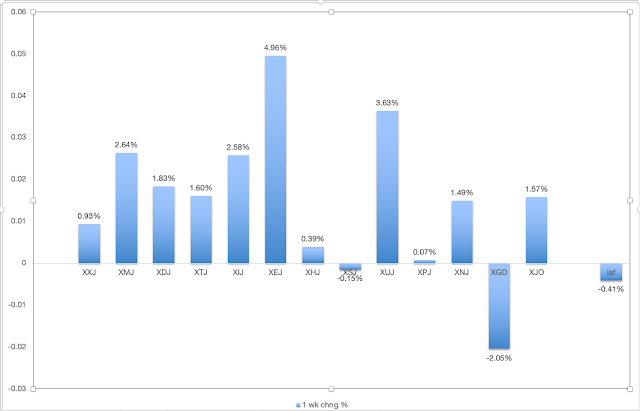

Commodities Index +1.91%. Energy +2.09%. Base Metals +3.08%. Agriculture +0.25%. Gold +0.66%.With both stocks on commodities on the rise, we should have another good day on the ASX on Monday.

Bitcoin.

Bitcoin fell back -5.84% overnight. This remains a day-trader's market. Long term investors might look elsewhere.

Stay Safe