Weekly Wrap, Week ended 7 October, 2022. Is the Bear finished?

XJO Monthly Chart.

XJO has made a good start to the month, but this is only Week One of October. We take no action on the basis of this chart until the end of the month.

Currently, the chart remains in a down-trend despite the solid action in the past week.

XJO Weekly Chart.

XJO had a strong rally this week, up +4.46% and erased big losses from the previous two weeks.

This week's candle has crossed above the 8-Week EMA, albeit only marginally. One of the two Supertrend lines has switched from blue (bearish) to yellow (bullish). XJO has run into the resistance of the other Supertrend lines.

XJO Daily Chart.

XJO was up strongly on Tuesday and Wednesday, but the action on Thursday and Friday suggests that momentum has waned.

The Index remains within the confines of the descending broadening wedge shown on the chart. A break to the upside of that wedge would be bullish, but then it faces the resistance of the 200-Day MA. As a general rule, it is best not to enter long-term positions while the chart is below the 200-Day MA.

Despite the good rally this week, the chart remains in a down-trend with lower highs and lower lows.

SP500 Daily.

Friday in America was Jobs Report Day. The jobs outlook was good - which was bad news for stocks because it suggested that the Federal Reserve had economic room to continue with their tough line on inflation. So stocks sank.

The chart has now formed an Island Reversal pattern. Candles for Tues/Wed/Thurs have been left isolated with gaps before and after those three days. Such a pattern has a poor prognosis for stocks.

That big down day on Friday will almost certainly flow through to Australia on Monday, confirming the reversal of momentum suggested by action in Australia on Thursday and Friday.

The Bear continues to live - for now.

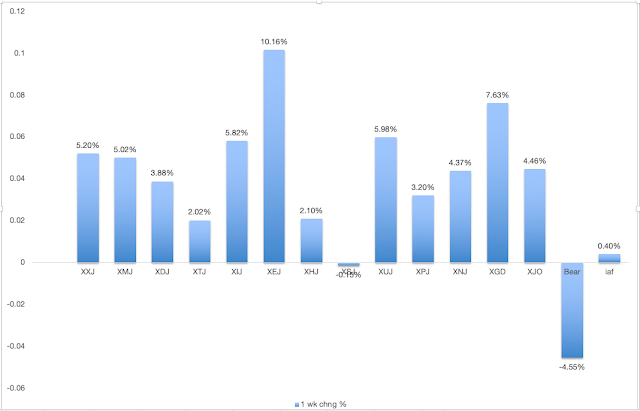

ASX Sector Results for this week.

Ten out of eleven sectors were up this week with some stunning results, led by Energy >10% to the upside. Five sector rose by >5%. Only one sector was down - Consumer Staples, and it was down only marginally -0.15%. That sector was hampered by poor results in the two big retailers, Coles and Woolworths.

We often see such sharp rises during bear markets. They can trap traders/investors into thinking that the bear market is over.

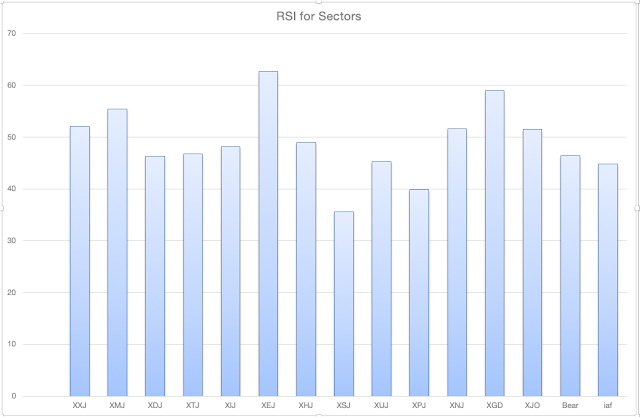

Relative Strength of Sectors.

RSI (Relative Strength Index) is calculated using the default setting of

14 days - almost three weeks of trading. It provides a more reliable

guide to changes in sectors than the one-week results which can jerk

around quite a lot and, thus, RSI is probably a more reliable guide to

recent strength in the sectors. (Click here for a description of RSI.)

Four sectors out of eleven are above 50: Financials (XXJ), Materials (XMJ), Energy (XEJ) and Industrials (XNJ). That is an improvement, however, from a couple of weeks ago when all eleven sectors were below 50.

This can be taken as a measure of breadth in the market. With seven sectors below 50 and four sectors above 50, the market remains bearish.

NewHighs-NewLows Cumulative.

This is a metric for the long-term investor. While NH-NL Cumulative remains below its 10-Day Moving Average, it is best to remain cautious and defensive regarding the market.

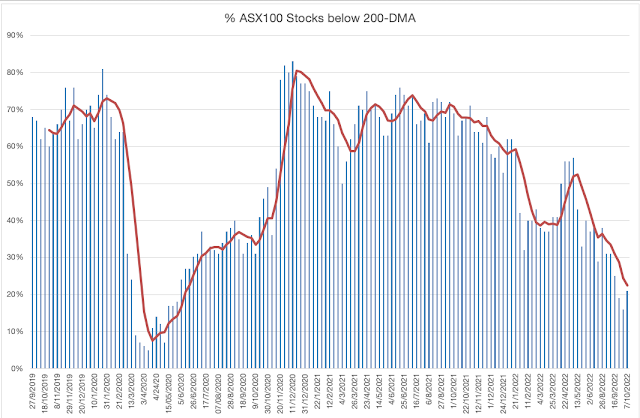

% of Stocks above key moving averages.

1. % of stocks above 10-Day Moving Average: Last Week 13%, This Week 76%. This result reflects the sharp upside rally seen in the ASX this week. This is a short-term measure and is bordering on overbought.

2. % of stocks above 50-Day Moving Average, Last Week 12%, This Week 26%. This remains bearish.

3. % of stocks above 200-Day Moving Average, Last Week 16%, This Week 21%. That's an improvement but still bearish.

The long term metric (% Stocks below 200-Day MA) remains very bearish. I'd like to see this above at least 40% before feeling comfortable.

Conclusion.

ASX experienced a sharp upside rally this week and one could be forgiven for thinking that the bear had been vanquished. But action in America on Friday after the Jobs Report suggests the Bear is alive and kicking.

Stay Safe.