Weekly Wrap - Week ending 12 August, 2022.

XJO Monthly Chart.

We are now into the third week of August, with another week or so before the end of the month.

Both Supertrend Lines remain blue (bearish). 8-Month EMA is sideways, that's ambiguous. Hull MA13 is headed down.

All indicators are on the bearish side.

The XJO has found support at the 50-Month EMA where it also found support back at the end of 2018. This could be the start of a rebound, but with the seasonally weak months of September and October looming, any rebound is likely to be cut short.

Weekly Chart.

XJO was up this week, +1,17%. The chart is bullish and is now up five weeks in a row.

The index has found support at the 200-Week MA and finished above its 8-Week EMA which is pointing up. HullMA13 has turned up.

Both Supertrend lines have switched from blue to yellow - bullish.

All of that is bullish.

Monthly and Weekly Charts are out of sync (Monthly - bearish, Weekly bullish) so we are seeing a trend change in the medium term.

Daily Chart.

Hull MA13, two Supertrend lines and 8-Day EMA are all heading to the upside - bullish.

The short-term trend is bullish, but cautionary notes are entering this chart with a negative divergence showing up on CCI and MACD Histogram turning negative.

The chart is approaching the 200-Day MA - that's considered a line between a bullish and bearish market. It may provide stiff resistance to further upside.

SP500 is bullish in the Medium-Term but cracks are appearing in the Short-Term. Most obviously it has been rejected at the 200-Day MA.

RSI was overbought but has now broken below the 70 level. That's a bearish development.

MACD Histogram has turned negative - another bearish development.

XJO is likely to follow the U.S. down on Monday, also giving us a rejection of our market at the 200-Day MA.

Sector Strengths by RSI.

RSI (Relative Strength Index) is calculated using the default setting of 14 days - almost three weeks of trading. It provides a more reliable guide to changes in sectors than the one-week results which can jerk around quite a lot and, thus, RSI is probably a more reliable guide to recent strength in the sectors. (Click

here for a description of RSI.)

Nine of eleven sectors have readings above 50 - that is taken as a sign of bullishness but that is a weakening from the previous week when all eleven sectors were above 50.

The big surprise sector this week was Consumer Staples (XSJ) with an RSI at 73.9. XSJ is an important Defensive Sector. Financials (XXJ) continues to weaken with an RSI below 60 - two weeks ago it was above 70 so momentum in XXJ, the largest sector in our market, is slowing. Reporting season brought havoc to a couple of XXJ stocks. BEN, for example, had an RSI of 69.23 last week. This week its RSI 37.2, OUCH. An even worse smack-down occurred for TPG (in Telecoms). Last week, TPG had an RSI of 70.16, this week it is 31.89

The two Resources Sectors (XMJ and XEJ) are both showing improvement. Look for improving stocks in those two sectors and XSJ.

1. New Highs - New Lows Cumulative.

This is one of the important breadth indicators. Unless breadth is solidly positive, the market is always under threat.

The 10-Day MA of New Lows is now below the 10-Day MA for New Highs, but both metrics remain at very low levels. Until we see a decisive kick up in New Highs, I think it is advisable to stay on the sidelines.

Here's the cumulative chart for NewHighs-NewLows:

This metric usually trends very strongly. As such it is a valuable guide to the long-term investor, but not much use to the short-term trader. It gave a timely signal to go long in May 2020, and a sell signal in January 2022. That's a good run for the long-term investor.

At the moment, however, this Index is not trending strongly enough to say one way or the other.

If NH-NL Cumulative gives a new buy signal, I'll put that up on my

blog during the week rather than wait for the week-end.

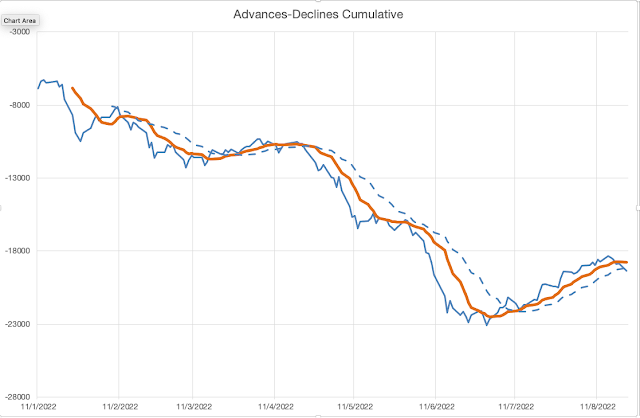

2. ASX Advance-Decline Line.

This is another important indicator of breadth.

ASX A-D Line tends to give medium-term trade signals compared to the longer-term signals for NH-NL.

The ASX Advance-Decline Line turned bullish at the beginning of July, predicting the good month we've seen for stocks in July and August. This week it is tending to bearish with the A-D Line below its 10-Day MA. A turn-down below the 20-Day MA would confirm a bearish twist.

% of Stocks above key moving averages.

1. % of stocks above 10-Day Moving Average: Last Week 47%, This Week 46%.

2. % of stocks above 50-Day Moving Average, Last Week 75%, This Week 71%.

3. % of stocks above 200-Day Moving Average, Last Week 43%, This Week 41%

Although XJO was up 1.17% this week, momentum on all three metrics slowed a little. That's unusual during a strong up week.

I'd like to see all of these above 50% to feel comfortable about the longer term bull market.

Conclusion.

1. Monthly, Weekly and Daily Charts are not in sync, one bearish, two bullish.

2. The short term trend will be in doubt if, as expected, XJO follows the SP500 and falls down from the 200-Day MA.

3. Breadth according to Advances-Declines is falling but we still have to wait on NH-NL Cum to break clearly to the upside.

4. XSJ, XMJ and XEJ have strongest momentum. Look to strong stocks in those sectors. Do your own research on stocks in those Sectors. We are in reporting season and surprises can hit apparently strong stocks as we saw in BEN and TPG this week. ETFs are less volatile.

5. In the short-term, the market is losing momentum and breadth is in doubt. Changes in breadth, e.g., A-D Line, have a good record of predicting down-turns.

Stay safe.