2/7/22. Yesterday in Australia.

XJO fell -0.43%

XJO has now been down three days in a row. The chart is bearish on all time frames, short, medium and long term. This is a market for traders, not for investors.

Overnight. American Equities bounce higher.

Dow Jones +1.05%. SP500 +1.06%. Nasdaq +0.9%. Small Caps +0.93%. Banks +1.53%.

SP500.

SP500 bounced off support and remains in its short-term consolidation. A test of overhead resistance seems likely. Wait.

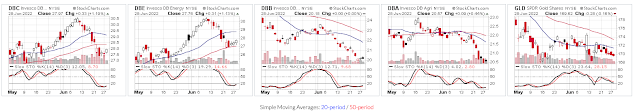

Commodities.

Commodities Index +0.49%. Energy +1.64%. Base Metals -0.67%. Agriculture -1.96%. Gold -0.08%.

The rise in Energy has come at the low end of a down trend, and under heavy volume. That could be the end of the down-trend in Energy.

20-Year Treasuries (U.S.)

TLT (20-Yr) Treasuries up last night +0.83% (yields lower).The past two session have seen strong intra-day selling (long upper wicks on candles), so Bond Bears haven't given up yet.

Last night's selling came as TLT hit resistance of the Kumo Cloud. This might be the end of the short-term bullish rally - which is not a good sign for stocks.

U.S. is shut for Independence Day on Monday. XJO usually pulls a surprise when U.S. is shut for holidays. That could be up or down. The next couple of days could be interesting in Australia.