Weekly Wrap - Week ending 17 June, 2022.

XJO Monthly Chart.

XJO is into the third week of June. The chart is bearish.

The monthly chart has broken down from its previous range 6930-7539, and finished the week at 6475

Both Supertrend Lines have turned blue (bearish). All indicators are on the bearish side.

Weekly Chart.

The Index broke below support at the beginning of the week, and more or less, kept going down. In the process it broke support of the 200-Week Moving Average. Not a good sign.

RSI14 is now very oversold at 28.73 - which means there is some hope of a rebound, giving embattled investors the opportunity to sell stock at a higher price.

XJO has fallen -10.55% in the past two weeks. That's the worst two-week period since the end of the 2020 Bear Market.

Monthly and Weekly Charts are in sync - bearish.

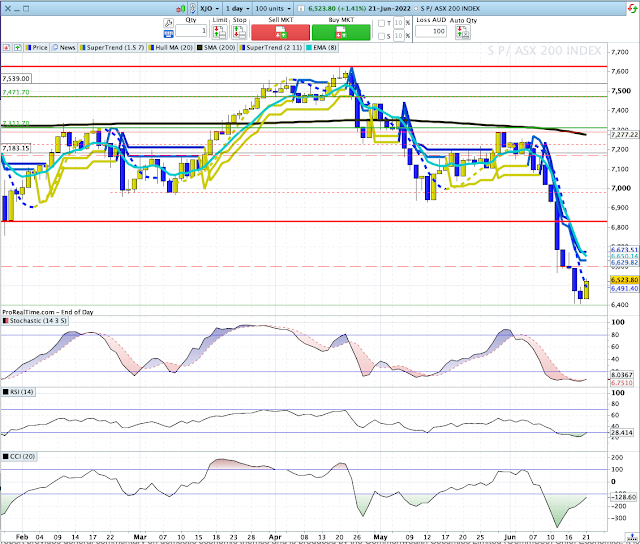

Daily Chart.

Both Supertrend Lines are blue and heading down, Hull MA13 is blue and heading down; 8-DEMA is also heading down. There's not much joy in those moving averages.

The double positive divergence on the MACD histogram and the MACD itself, which suggested a possible move to the upside, has now disappeared. Another bearish indicator..

All three time frames are in sync - bearish. Only take sell signals. If there is a rebound, look to sell the rally.

With RSI14, Daily Chart, at 22.53 (an extremely low reading) a rebound is possible.

SP500.

On Monday, SP500 broke support and continued down for most of the week.

Two Supertrend Lines and HullMA13 are all blue (bearish). A change to yellow would suggest a counter-trend rally.

Sector Changes - past week.

This chart shows this week's carnage across all 11 Sectors (plus Gold Miners, XJO, BEAR and IAF).

No Sectors were up. The two best performing sectors were both defensives, Telecommunications (XTJ) -2.35% and Consumer Staples (XSJ) -3.01%. Calling XTJ a "defensive" was ok in the recent past, but its composition has been adjusted to include stocks like REA and SEK which are cyclical in nature rather than defensive. At best, I think XTJ should be considered a hybrid, with some defensive stocks and some cyclical stocks.

Worst performers were Information Technology (XIJ) -9.81% and Energy (XEJ) -8.2%. XEJ has been one of the best performers in recent weeks, but its run seems to have ended.

Financials (XXJ) is the biggest sector in the market and a major drain on the performance of the XJO. XXJ has lost more than -15% in the past two weeks. Until XXJ starts to perform positively, there's not much hope for the XXJ.

New Highs - New Lows Cumulative.

This is one of the important breadth indicators. Unless breadth is solidly positive, the market is always under threat.

NH-NL Cumulative continues to fall and is now well under its 10-Day Moving Average, that's a big red danger sign for long-term investors.

ASX Advance-Decline Line.

This is another important indicator of breadth.

ASX Advance-Decline Line is also bearish, and in sync with NH-NL Cum.

% of Stocks above key moving averages.

1. % of stocks above 10-Day Moving Average: Last Week 17%, This Week 5%.

2. % of stocks above 50-Day Moving Average, Last Week 18%, This Week 3%.

3. % of stocks above 200-Day Moving Average, Last Week 29%, This Week 21%

Once these instruments all fall below 20, that's a contrarian signal that the market might bounce. Two out of three instruments are below 20. It would be even stronger if the third one was below 20, but we are looking at a very weak oversold market, so the chance of a bounce is good.

At the end of the March 2020 bear market, % of stocks above the 200-Day MA reached just 5%. This metric is currently at 21%, so it could go lower here.

Seasonally, we often see a medium term up-trend in stock markets. I'd wait and see how this pans out.

Stocks and their RSI14s.

Bear markets like this are a boon to number geeks like me. Some would say I take a ghoulish interest in the falls which are occurring. But - there are some fascinating numbers turning up on the RSIs.

Above 70 (overbought) is considered overbought on the RSI14. Currently in the ASX100, we have only two stocks which are both overbought (above 70), Crown and Atlas Arteria - both are under take-over offers which shot their charts into the stratosphere. Effectively we have no stocks on the overbought Zone.

60-69 Zone. Currently there are no stocks with RSIs in the 60-69 Zone.

50-59 Zone. Currently there are just four stocks in this zone. Two gold Miners (NCM, EVE), WDS (Woodside - which is falling) and EDV (Endeavor - which is rising). Gold Miners and EDV should attract interest from traders.

The 50 line on the RSI14 is often used in some trading strategies as a dividing line between bullish and bearish.

40-49 Zone. About 9% of ASX100 stocks fall in this zone - bearish.

30-39 Zone. This is the "Oversold Zone". 38% of ASX100 stocks fall into this zone.

20-29 Zone. This is the "Very Oversold Zone". 34% of ASX100 stocks fall into this zone. Rarely do stocks fall into this zone without rebounding.

10-19 Zone. Holy-Moly Batman, these stocks are absolutely cactus. 10% of ASX100 stocks fall into this zone.

A contrarian will look at those numbers and think, "We're due for a rebound". Contrarian signals don't provide highly reliable signals but they usually prove correct in the near future. A rebound is close. Watch for a break to the upside (above 20) on the daily Stochastic.

Conclusion.

1. Monthly, Weekly and Daily Charts are all in sync - bearish. Any rebound should be a signal to sell into the rally.

2. Breadth is poor, so poor that contrarians will be salivating at the prospect of new buying coming into the market. Contrarian signs are not always reliable, and sometimes well ahead of what could happen.

3. We need to see a move up on the Stochastic Daily chart for short-term traders to go long.