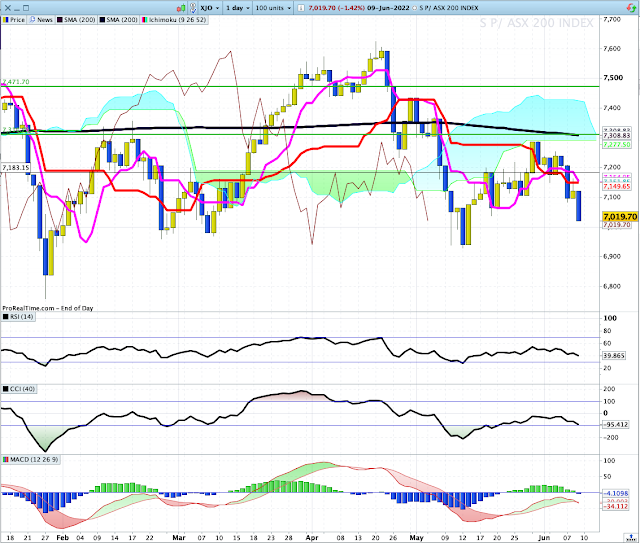

11/6/22. In Australia yesterday.

Yesterday, XJO fell -1.25%, or -87.7 points. For the week, XJO was down -4.24%. That's the worst weekly performance since April, 2020, just after the bear market of March, 2020.

A 52-week low was set for the XJO at the end of January, 2022. The close on that day was 6838.3. XJO finished yesterday at 6932. That's 93.7 points away. That's feasible given the magnitude of falls this week. That 52-week low could be a turning point.

Stochastic is in its oversold level, RSI14 is at 35.95 which is oversold. Another big fall coming on Monday could take RSI14 into vey oversold territory which might be a catalyst for an upside move. Of course, very oversold can become more very oversold back in March 2020.

Australian Banks are showing some promise of a rebound. Below is a chart for ANZ:

CCI and Money Flow Index both show striking positive divergences from the ANZ chart. Those two indicators are often good leading indicators for a trend reversal.

Yesterday's candle is a huge "tombstone" candle. The upper wick is especially long. Tombstones are often seen at the end of a down-trend.

RSI14 is extremely oversold at 21.43. Rarely do we see a reading below 25 without a rebound.

Stochastic is in its oversold zone. A move up would indicate a short-term buy signal. Any move up could precipitate a short covering rally.

Overnight.

Dow Jones -2.73%. SP500 +2.91%. Nasdaq -3.52%. Small Daps -2.49%. Banks -4.34%.

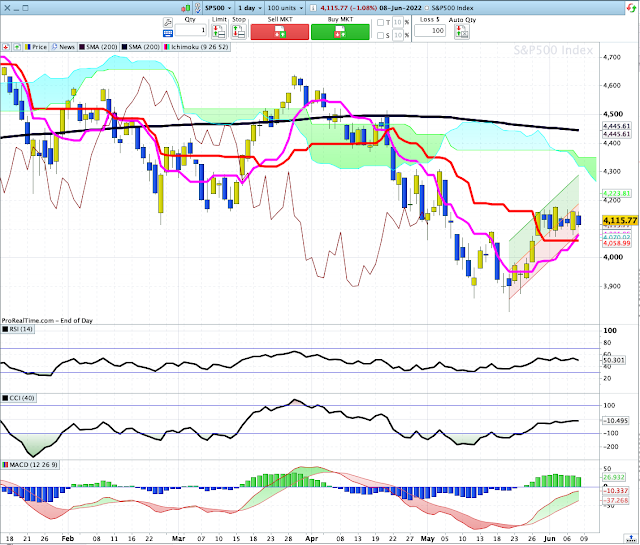

SP500.

SP500 gapped down at the opening and just kept going.

Money Flow Index shows an extreme positive divergence from price. So a bottom may be in place soon.

Commodities.

Commodities Index -0.98%. Energy -0.92%. Base Metals -1.79%. Gold +1.34%.

Gold gapped down at the opening, but then reversed to the upside under heavy buying. That could signal the end of the bearish market in Gold.

Gold.

The bullish engulfing candle last night in Gold took the Gold chart above the 200-Day MA, which often provides a "go" signal for gold bugs. GLD is now at resistance of the 50-Day MA, but the current momentum seems likely to overcome that resistance.