Overnight.

|

Dow Jones -1.94%. SP500 -2.38%. Nasdaq -2.75%. Small Caps -1.92%. Banks -3.16%.

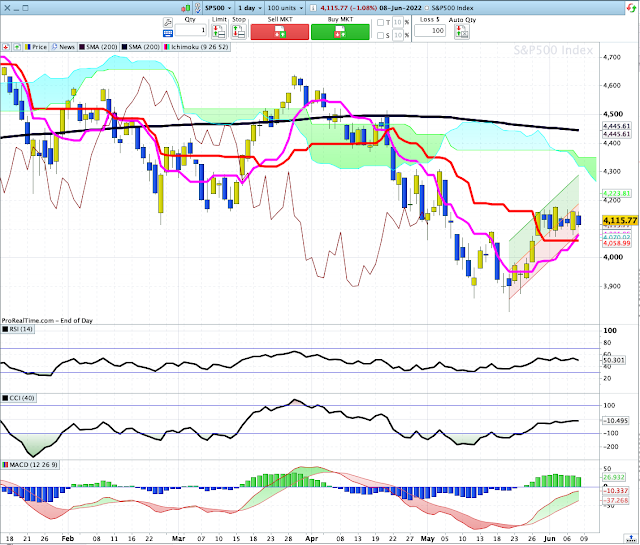

SP500.

SP500 has broken down from its eight-day consolidation. Stochastic has crossed below its 80-line. That suggests we'll see more downside.

Commodities.

Commodities Index +0.16%. Energy +0.33%. Base Metals -2.04%. Agriculture 0.00%. Gold -0.32%.

Iron Ore -1.4%. Thermal Coal +0.2%.

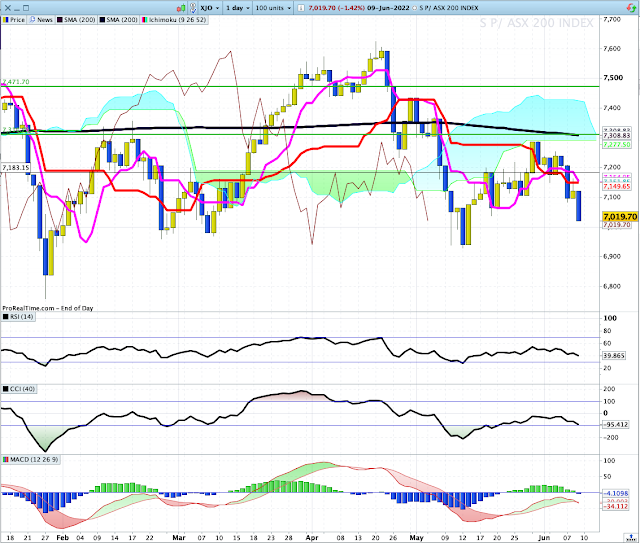

Overnight Oz Futures -0.8%. It seems we'll have another grim day on the ASX.