4/6/22. Yesterday in Australia.

XJO had a strong day, up +0.88% erasing the loss of the previous day.

The index remains in its upscoping Standard Error Channel and between horizontal support of 7106 and horizontal resistance of 7300. Just above that is the 200-Day SMA at 7316. XJO finished yesterday at 7239. Dual resistance is usual difficult to overcome specially when one of those is the 200-DSMA.

Overnight in America.

The American market finished the week on a losing note.

Dow Jones -1.05%. SP500 -1.63%. Nasdaq -2.47%. Small Caps -0.91%. Banks -1.41%.

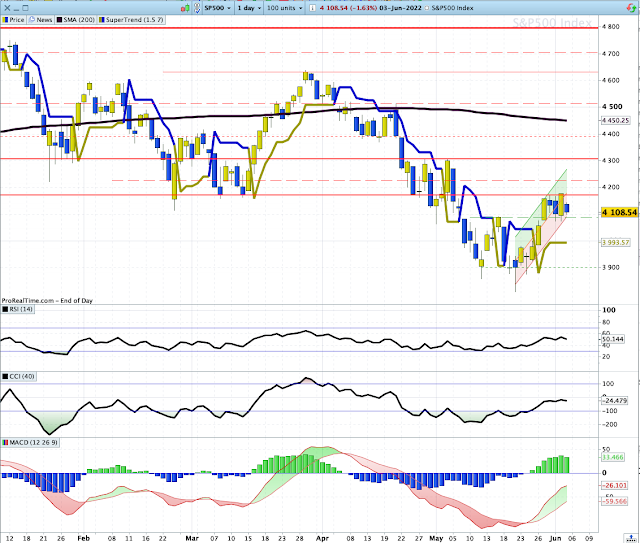

SP500.

SP500 also remains in its up-sloping Standard Error Channel and consolidating in a tight range between 4089 and 4170. SP500 finished at 4178.

The recent low was formed on 20/5/22. The candle on that day had a long lower tail and looks to me like a Wyckoffian "Spring" which usually suggests the end of a major down-trend.

Nothing ever goes in a straight line, so we can expect some to-and-froing with the next move to the down-side, shaking out some hopeful bulls before the next major move to the upside. We shall see.

Commodities.

Commodities Index +0.95% was pushed up by Energy +1.94%. Base Metals down heavily -1.95%. Agriculture also down -0.95%. Gold -1.02%

None of the overnight results looks promising for the Australian market on Monday.

New York Advances-Declines Line.

NY A-D Line is in an uptrend, coincident with the SP500.

It gave early warning of a change to the SPX downtrend with a positive divergence occurring 11-20 May while the SP500 was still down-trending. Hopefully, it will give us a negative divergence before any change to a down-trend of the SP500.