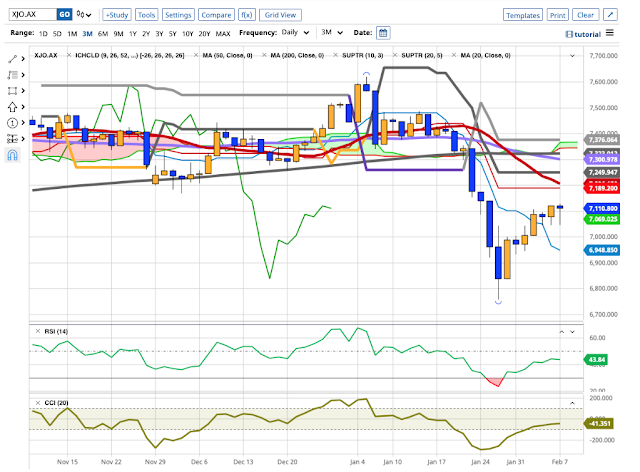

XJO finished up today, +0.28%.

XJO was confronted today by the 50-Day and 200-Day Moving Averages and failed to finish above either of those. It marginally broke above the 200-Day MA (the higher of the two key MAs) then retreated back below the 50-Day MA.

Coming at the top of the trend, that's a sign of weakness. We need to see downside tomorrow to confirm.

Seven out of eleven sectors were negative today and one finished flat. So we have an unbalanced market. The overall positive result was largely due to Financials (XXJ +0.9%) which is the largest sector in the market. XXJ had another big bank reporting today, NAB up +4.5%. But the reporting by the banks is now done. They've been a big part of the current rally. Without any more big results coming in from the banks - that's another reason for thinking the market might pause or pull back here.

Currently in Europe, both the DAX and FTSE are up a little, but that's a tenuous positive lead.

Let's see how tomorrow goes.