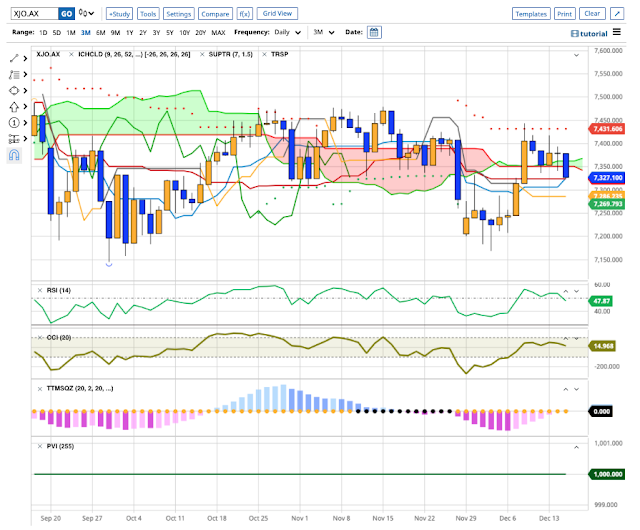

Thu. p.m. 16/12/21. Despite strong gains overnight, the Australia market fell today.

XJO down today -0.43%.

XJO remains in a short-term down-trend, but in a medium-term sideways consolidation, basically going nowhere.

Today wasn't as bad as the raw figure for the XJO suggests. Breadth was OK, with NH-NL = 15, and Advances -Declines = +97. CSL was a big drag on the system today. CSL -8.2%. CSL is the third largest stock on the ASX200. BHP fell -1%. CBA -0.1%. Small Caps were up +1.8%. Mid-cap 50 was up +0.15%. So, it was a case of some large cap stocks falling while the rest of the market showed resilience. Not too bad in the scheme of things.