25/3/23. Saturday Finspiration Report.

Yesterday - XJO down marginally after strong intra-day buying.

Last night - U.S. stocks finish positive.

XJO Friday:

XJO down -0.2% yesterday. The long lower wick on yesterday's candle indicates strong intra-day buying.

The only positive on the chart is the Hull MA13 which is the shortest MA I use.

XJO remains below the 200-Day MA. It has been rejected by the 10-Day MA and the first line of the triple Supertrends. We need to see better than that to enter for a trade.

Overnight in the U.S. Major indices finish up modestly. Regional Banks have a big rise.

Dow Jones +0.41%. SP500 +0.56%. Nasdaq +0.31%. Small Caps +1.07%. Regional Banks +3.03%. Despite that big rise in Region Banks, the chart remains mired at the low end of its big down-trend.

SP500.

SP500 is doing better than Australia's XJO. It finished last night above its 200-Day MA and above all three of the triple Supertrends.

Hull MA13 is positive and the Index finished above the 10-Day MA.

The index remains locked between the 50-Day MA and the 200-Day MA. A move above the 50-Day MA would be bullish.

Commodities.

Commodities Index +0.48%. Energy +0.2%. Base Metals flat -0.05%. Agriculture +1.53%. Gold -1.13%.

The upside movements in the American Indices suggest that the Australian market will be up on Monday.

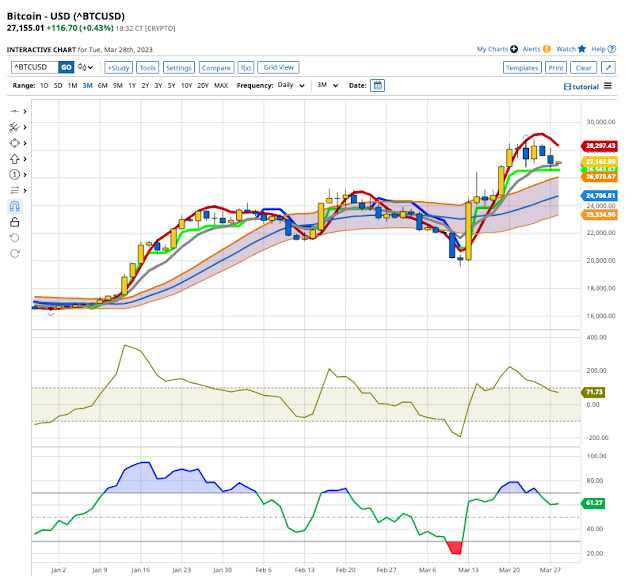

Bitcoin.

Overnight, Bitcoin was down -2.41%. The Hull MA13 has turned down which is a short-term negative signal.

Longer term, BTC remains bullish - above the 10-Day MA and triple Supertrends.