28/1/23. Finspiration Saturday Report.

Dow Jones flat, Nasdaq up.

Dow Jones +0.08%. SP500 +0.25%. Nasdaq +0.95%. Small Caps +0.36%. Banks +0.55%.

SP500 Daily and Weekly Charts.

Both Daily and Weekly Charts are bullish with triple Supertrend Lines showing yellow (Bullish)

Daily SP500 has moved above the 200-Day MA and its downtrend line. The chart is now hitting horizontal resistance. The chart must finish above both horizontal and oblique lines to prove the down trend is over.

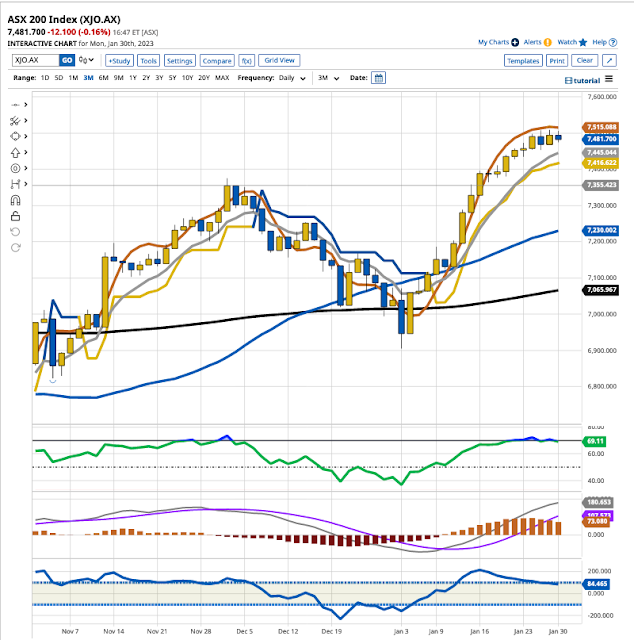

XJO Daily Chart.

XJO is overbought and consolidating at the highs. CCI shows a negative divergence suggesting a pull-back may be coming. But, until we see definite evidence otherwise, stay with the trend.

Commodities.

Commodities Index suffered a reversal last night, down -1.12%. Energy -1.82%. Base Metals -1.21%. Agriculture +0.2%. Gold showed intra-day buying but finished down a little, -0.14%.

BHP fell in New York, -1.91%, but the uptrend remains bullish. Rio also fell -0.98% but showed plenty of intra-day buying after falling heavily in early trade. It rebounded at the key 11.00 (NY time) reversal segment.

Bitcoin.

Bitcoin finished flat last night +0.08%. It continues to consolidate around the 200-Day MA.

CCI suggests a pull-back may occur, but the best policy, I believe, is to stay with the up-trend until evidence suggests otherwise.